Jory and Jill’s Personal Impact Investing Journey

by Jory Cohen, Director of Social Finance and Investment

As the Director of Social Finance and Investment at the Inspirit Foundation, I manage Inspirit’s asset base of about $36 million. My job is to align our investments with our vision of contributing to a more inclusive society where differences are valued and everyone has equal opportunity to thrive socially and economically. The goal is for every single dollar of our asset base to be leveraged for positive impact and contribute to our vision while earning a risk- adjusted, market-rate return.

We’re currently in the second year of our five-year plan to establish a 100% impact portfolio. So far so good.

Recently, I was lucky enough to marry my best friend, Jill. We believe the way we think about and use money matters. Money can be used as a tool to perpetuate harm and unethical behaviour; it can also be intentionally leveraged for good. That’s why, like Inspirit, we’ve committed to aligning 100% of our personal investable assets with our vision of how we want the world to be.

Before we dive into an analysis of our current investments, here’s a little more about me: I work in the field of impact investing, which is an approach to investing that seeks to generate both financial returns and positive impact (social and environmental). For me, a successful investment does well financially while simultaneously doing ‘good’ in the form of serving people or protecting the planet. Some examples of impact investments include clean energy, sustainable agriculture, and microfinance–the list goes on.

There is evidence that impact investing generates stronger long-term financial returns than traditional investing. Research suggests that companies that are part of the solution to our world’s social and environmental problems will financially outperform companies that cause the problems. For example, clean energy companies are projected to outperform fossil fuel producers over the long-term. It is well documented that fossil fuel producers significantly contribute to climate change through carbon emissions. If the world is to have a reasonable chance of limiting a global temperature increase to 2°C, fossil fuel producers will need to reduce their output significantly. They are part of the problem; clean energy, on the other hand, is part of the solution. Based on my research, I’m betting that the future value of fossil fuel producers will be negatively affected once public policy and market pressure restrict these companies from extracting and burning the content of their reserves.

Guided by our vision for how we want the world to be and leveraging my professional experience, Jill and I focused on understanding the impact of our personal investments. We define positive impact as investments in companies that a) are top performers along environmental, social, and governance metrics and b) contribute to the United Nations Sustainable Development Goals. We measure a company’s contribution to the United Nations Sustainable Development Goals by the amount of revenue the company earns from products and services that achieve the desired outcomes of the 17 Goals.

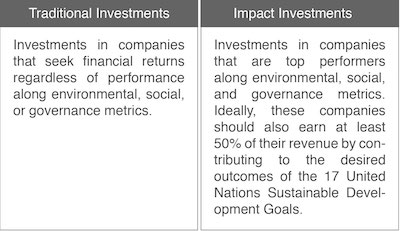

In order to understand our current portfolio and track our progress, we borrowed a framework adopted by Inspirit that classifies our investments into two distinct categories:

The goal is to have 100% of our capital allocated to impact investments. Ideally, as much capital as possible will be shifted to companies that generate the highest percentage of their revenue by contributing to the outcomes of the United Nations Sustainable Development Goals.

Below is a snapshot of our portfolio as of December 31, 2016.

Traditional investments : 95%

Impact investments : 5%

The initial tally is in, and it’s not a pretty picture: 95% of our assets are traditional investments that don’t align with our vision, or maybe even work against it! There’s clearly a lot of work to do.

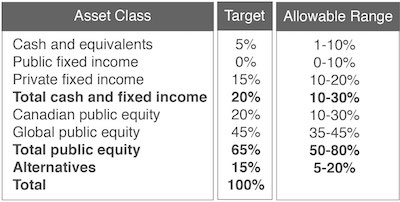

It’s worth noting that we’ll be structuring our portfolio to mitigate risk by diversifying across asset class, geography, and currency. The below asset mix allocation is a guide for our future investing activity. It’s not set in stone, and it’s certainly up for debate since I’ve yet to stumble across consensus over an optimal asset allocation mix.

For those who are familiar with asset allocation mixes, you might notice a relatively high target for private fixed income and a low one for public fixed income. The rationale behind this target is a 5% annualized return expectation from private debt instruments, which would be a significant financial outperformance of the often sub-2% annualized returns found in the public fixed income market right now.

Investing in private fixed income also allows us to generate the positive impact we desire. For example, our current private fixed income investments build clean energy infrastructure (SolarShare – 5% annualized return), support co-working spaces dedicated to social innovation (Centre for Social Innovation – 3% annualized return) and finance social enterprises led by young entrepreneurs (Youth Social Innovation Capital Fund – 8% annualized return)*.

We also set a relatively high allocation to alternatives, as we expect this asset class to increase the overall financial and impactful success of our portfolio. Examples of alternative investments with the potential for high financial returns while generating positive impact include a) private equity funds that focus on themes like water, sustainable agriculture, or gender equity; and b) infrastructure funds that finance projects like hospitals, schools, and clean energy. We currently have one private equity investment, which is in Impak Finance, the first bank in Canada that invests all of its deposits to achieve positive impact. Although, this investment is extremely small and is less than 1% of our existing portfolio.

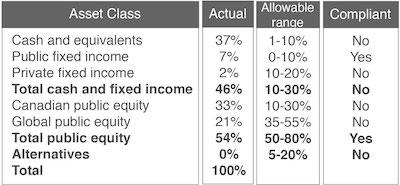

This is how our current portfolio looks:

For some context, Jill and I got married a few months ago and that’s the main reason we’re overweight in cash at the moment. Not only did we receive generous gifts from our friends and family (thank you!), we’re also in the process of merging our finances, which forced us into some cash positions. As we shift our assets to increase the impact of our investments, we’ll be aligning our decisions with our targeted asset allocation mix.

Jill and I believe there will always be methods to incrementally increase the impact of a portfolio. We’ll be sharing our progress towards a 100% impact portfolio in upcoming blog posts, which will explain the rationale behind each investment decision. We hope you will follow along with us. Be sure to read Part 2, Part 3 and Part 4 of Jill and my personal impact investing journey.

[vc_video title=”Journey to personal impact investing” link=”https://www.youtube.com/watch?v=QRFY5goZnCA”]

* Prior to Inspirit, I was the Managing Director of the Youth Social Innovation Capital Fund and now sit on their Board of Directors.

DISCLAIMER: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice to find out what works best for you.