Investing

We recognize that impact investing is an important tool for change. We invest in companies whose values align with our mission and whose work contributes to systemic change.

Our vision of inclusion and pluralism requires us to leverage our investment capital.

As a result, we implemented a 100% impact portfolio, with the goal of using our full asset base to further our mission. We reached that goal in 2022. We continue to iterate to deepen the impact of our investments even beyond the 100% impact portfolio, as we believe this is crucial for the systemic change we need to realize our vision.

Impact investing is crucial for creating systemic change needed to realize our mission.

Investment Portfolio

Traditional Investments

Investments in companies not necessarily relevant to Inspirit’s vision of inclusion and pluralism.

Impact Investments

Investments in companies that are top performers along environmental, social, and governance metrics associated with our organizational vision. These companies also earn a majority of their revenue through products and services that contribute to a more inclusive and pluralist society.

Impact Investing Grants

From time to time, Inspirit provides grants for initiatives focused on advancing racial, social and economic justice within the finance and investment sector.

Projects previously funded through this stream include the Reconciliation and Responsible Investing Initiative’s work to promote thoughtful investment policies and practices that include the wellbeing of Indigenous individuals and communities.

Impact Investing Insights

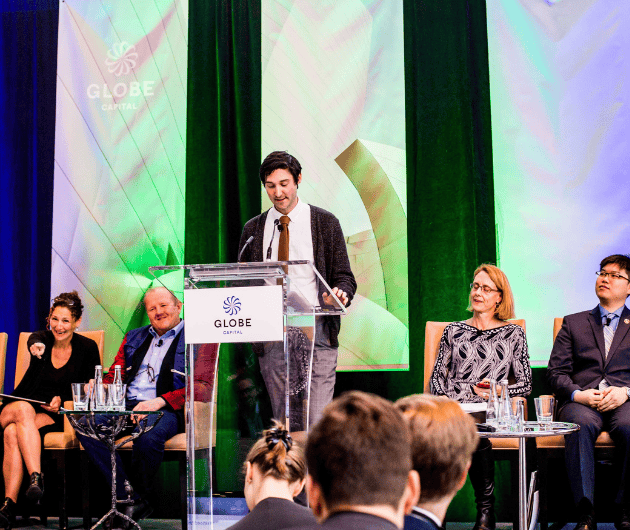

Impact Investing Op-ed in The Globe and Mail

Jory Cohen, Inspirit’s Director of Finance and Impact Investment, wrote an opinion editorial for The Globe and Mail around the benefits of impact investing.

The Next Evolution of our Impact Investment Portfolio

As Inspirit’s seven-year impact investing journey has formally come to an end, we have been asking ourselves what’s next? How can we push ourselves further? We believe we have one answer.

Jory and Jill’s Impact Investing Journey: Part 16

Part 16 of Jory and Jill’s impact investing journey features their investment in the Honeytree U.S. Equity ETF.

Impact Investing and the Pandemic: Part 9

The final part of the “Impact Investing and the Pandemic” series provides insight on Inspirit’s investments and impact-centric approach during the pandemic.