Impact Investing and the Pandemic: Part 9

By Jory Cohen, Director of Finance and Impact Investment, Inspirit Foundation

For more than three years, Inspirit has been openly sharing how our investments and our impact-centric approach have navigated the pandemic, and now it’s time to provide some conclusionary comments. With the World Health Organization declaring, “COVID-19 over as a global health emergency” back in May, this post will mark the end of this blog series titled ‘Impact Investing and the Pandemic’.

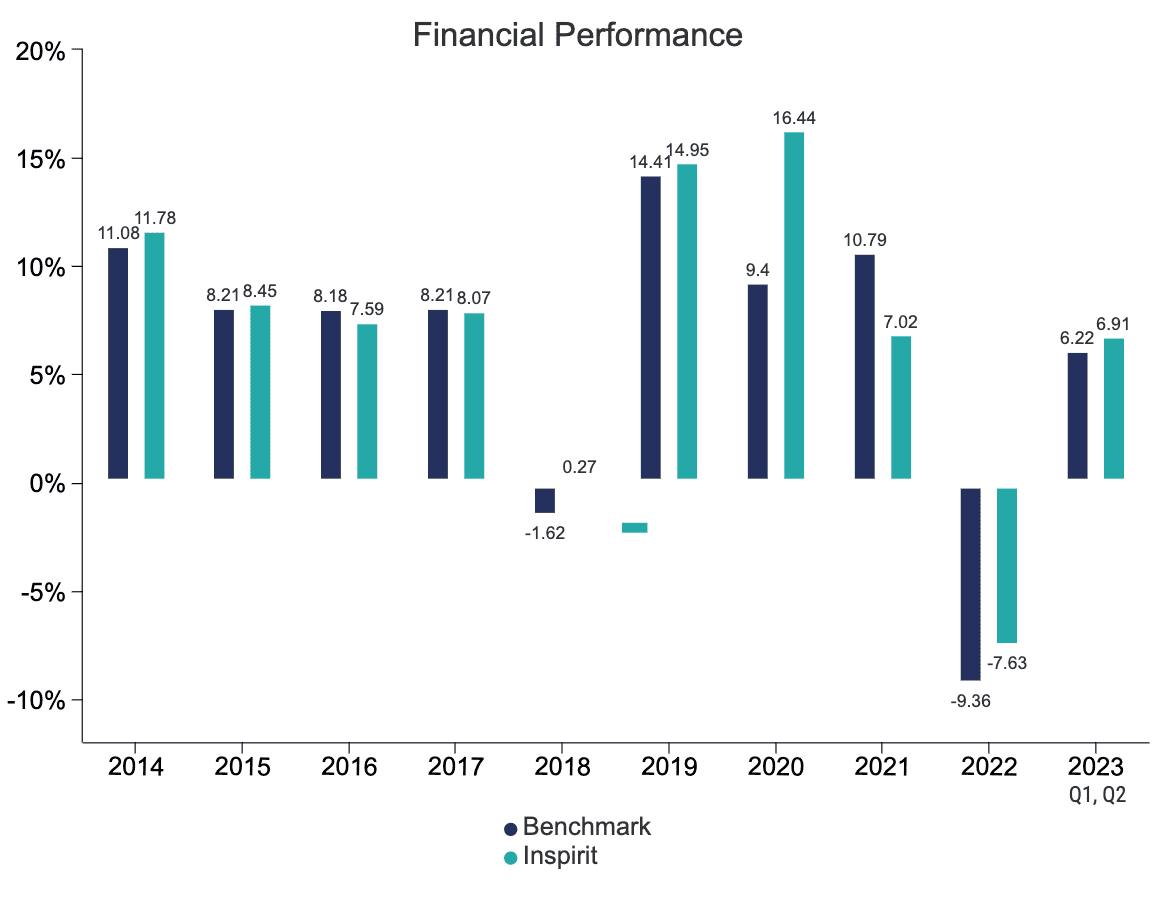

To recap, 2020 was an unprecedented year for the performance of our portfolio from both an absolute perspective and relative to our benchmark too. We experienced positive performance to the tune of more than 16%, outpacing benchmark by north of 7%. However, 2021 and 2022 told a different story. While returns were positive in 2021, we trailed benchmark. In 2022, the market took a downwards turn. Our portfolio posted negative returns, while also underperforming benchmark. Fast forward to 2023, as of the end of the first half of the year, our investments have bounced back, resulting in both positive absolute performance and outstripping benchmark too.

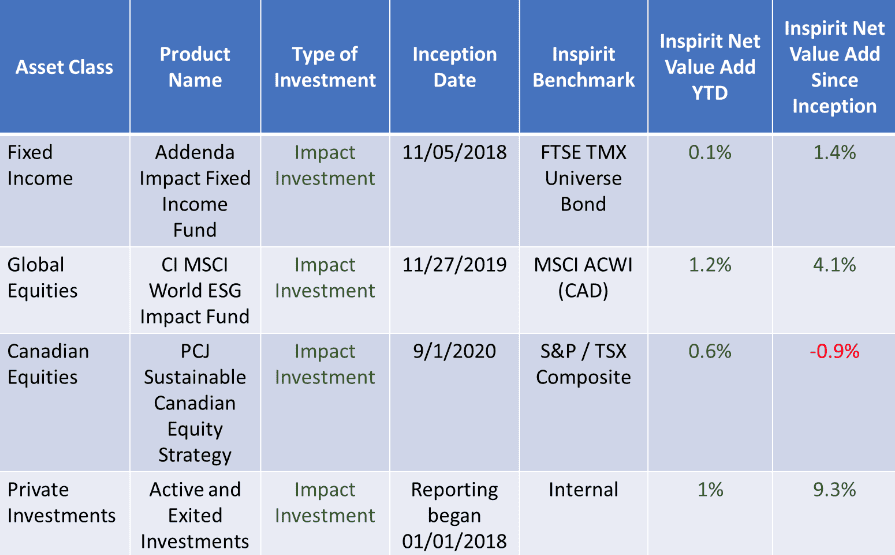

As a reminder, our benchmark is a combination of industry-standard indexes, like FTSE Canada Universe Bond for the fixed income allocation of our portfolio, S&P/TSX Composite for Canadian equities, and MSCI ACWI (CAD) for global equities. The overall benchmark is a composite of the above, weighted by investment policy target weight.

Overall, throughout the pandemic our portfolio’s performance can be categorized as broadly tracking market swings and trends, generally positive, and more favourable compared to benchmark. In fact, from the pandemic’s beginning to end, our portfolio netted 23.1%, while benchmark earned 20.1%. That’s a value-add of 3%, which we believe demonstrates the resilience of our investments and impact investing strategy. This is especially true given the recent surge of oil and gas prices, a sector which Inspirit carries no exposure.

The below graph measures the growth of a hypothetical $10,000 investment in our portfolio relative to benchmark since inception. There is outperformance both before and during the pandemic.

From an asset class perspective, all made gains on their associated benchmarks in the first half of 2023. Every single asset class, with the exception of our Canadian equities, has added value relative to benchmark since the beginning of their respective mandates. It’s worth mentioning that while it’s true our Canadian equities have lagged benchmark, it’s by a small amount, which is particularly noteworthy since this asset class (like all the others) has no exposure to oil and gas. Despite the energy sector’s surge in recent years, this asset class has held strong.

Writing this last blog post had me reflecting on these past few years. The pandemic has taken its toll, and it seems like we’re mostly on the other end of it. Of course, there are long-term effects that will continue to mark our lives, and the markets too. While this blog series has come to an end, Inspirit continues to commit to transparency and sharing our learnings along our investment journey. You can follow our progress and challenges here.