Achieving a 100% Impact Portfolio: Part 1

At Inspirit, we recognize that impact investing is an important tool. By investing in companies whose values align with our own organizational vision of inclusion, we can create much-needed systemic change. That’s why we have committed to transitioning our assets to a 100% impact portfolio. In making this change, we believe we can use our assets to generate financial returns as well as positive social and environmental impact.

We have formalized this commitment in our Investment Policy Statement, which serves as a guideline for making future investment decisions. The statement outlines three main principles that guide our investments: 1. Financial performance 2. Low carbon footprint 3. Positive impact By 2020, Inspirit expects to meet our goal of a 100% impact portfolio.

Here’s a look at the work we’ve already done and how we plan to get there:

The initial audit

To achieve our goal, Inspirit needed to learn more about our current investment portfolio. When we first committed to a 100% impact portfolio, most of the foundation’s assets were in the public market. The portfolio was handled by three investment managers, each tasked with investing across multiple asset classes: fixed income, Canadian equities and global equities. In order to analyze the performance of our portfolio, we conducted an audit examining our investments based on the three criteria outlined in our Investment Policy Statement.

Measuring the performance of our investments

To assess the financial performance of our investments, Inspirit enlisted the support of an investment consultant, Proteus. Using software from MSCI, an independent provider of investment support tools, we also measured the emissions associated with companies in our portfolio so that we could better understand each investment’s carbon footprint. Positive impact, the third requirement in our Investment Policy Statement, was assessed by measuring how well the companies in our portfolio complied with environmental, social and governance standards as well as how much revenue those companies earned by contributing to the United Nations’ Sustainable Development Goals.

How Inspirit’s investments stack up against other portfolios

Next, we compared the financial, carbon footprint and positive impact performance of our portfolio against a traditional benchmark, which included most of the bigger companies found on the stock market. For aspirational purposes, we also compared our portfolio’s performance to the MSCI Sustainable Impact Index. This is a benchmark that includes companies with strong financial results, a low carbon footprint, and high performance along environmental, social, and governance standards that also earn the majority of their revenues from products and services contributing to the Sustainable Development Goals.

Finding the right expertise to reach our goal

Inspirit’s analysis showed that our portfolio had room for improvement on financial, carbon and impact performance. The data we collected also clearly demonstrated to us that it’s rare for investment managers to achieve consistently high performance in all investments when managing a combination of asset classes. In order to improve our portfolio’s performance, we determined that we needed to transition our portfolio from three managers investing in multiple asset classes to individual managers specializing in a specific asset class.

A new direction

In May 2018, Inspirit invited investment managers to submit proposals outlining how we could satisfy the goals in our Investment Policy Statement. We chose to start our transition to this new investment approach by first focusing on our fixed income assets because this was the type of investment in our portfolio that showed the greatest room for improvement. After receiving a number of high-quality submissions, Inspirit scored each proposal based on five main criteria:

- Investment firm overview and their commitment to diversity, equity and inclusion

- Proposed product overview, thesis and fees

- Proposed product’s financial performance

- Proposed product’s carbon footprint performance

- Proposed product’s positive impact performance

We also conducted two rounds of interviews before coming to a final decision. In the end, we were pleased to select Addenda Capital as our new manager and allocate the entire public fixed income portion of our portfolio to their Impact Fixed Income Fund.

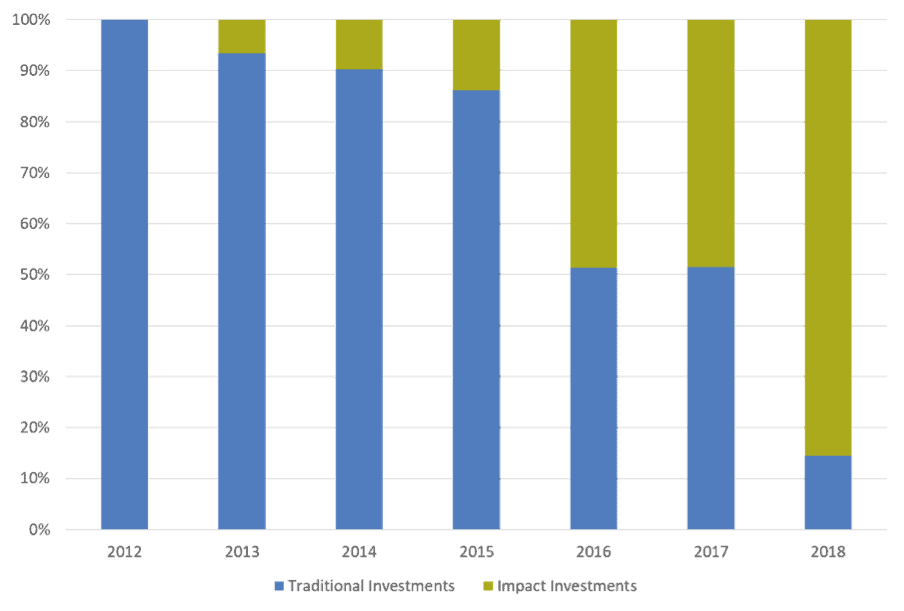

By investing in Addenda’s Impact Fixed Income Fund, over 33% of our portfolio is now devoted to impact investments. These investments are top performers when it comes to complying with environmental, social and governance standards and they also earn at least 50% of their revenue by contributing to the UN’s Sustainable Development Goals.

Inspirit’s Investment Portfolio: Traditional vs. Impact Investments

Figure 1: The progression of Inspirit’s investment portfolio from traditional investments to impact investments that align with Inspirit’s values.

What’s next

We plan to continue transitioning our portfolio from one with traditional investments to one entirely composed of impact investments. The next step will be to invite submissions for a global equities manager – and later a Canadian equities manager – who can satisfy the financial, carbon and positive impact goals outlined in our Investment Policy Statement. We expect to fully transition to a 100% impact portfolio by 2020. Please follow our progress here.

*In February 2020, we updated our definition of impact investing. The updated definition provides a more stringent focus on our impact investing and is a significant improvement.

An edited version of this blog post is also published on the Responsible Investment Association online magazine.