Achieving a 100% Impact Portfolio: Part 2

Given the recent volatility of the markets, Inspirit is even more committed to our impact investing strategy moving forward. In January 2016 Inspirit committed to a 100% impact portfolio, and became the only foundation in Canada to publicly state that as our goal. From the outset, we wanted to transition what was a relatively traditional portfolio to one entirely composed of impact investments by the end of 2020.

Since 2016, more than 80% of our portfolio has been allocated to publicly-traded investments. The balance is placed in private investments. In 2016, that 80+% of our portfolio was held by three investment managers with balanced mandates, meaning each of these investment firms managed Inspirit capital that spanned multiple public asset classes: fixed income, Canadian equities, and global equities.

In 2017 Inspirit conducted a study of the investment management sector and associated financial performance. Our analysis demonstrated that investment managers rarely outperform in multiple asset classes. The data actually showed that it was challenging enough to outperform in one asset class alone!

As a result, in May 2017 Inspirit published our Investment Policy Statement, a guide for making investment decisions. In that document, we outlined the three principles that guide our investment decision-making:

- Risk-adjusted financial performance

- Movement toward a low carbon portfolio

- Alignment with Inspirit’s organizational mission (positive impact)

After analyzing sector-wide data and our specific asset base according to Inspirit’s three investment principles, it became clear that Inspirit would benefit by transitioning from three investment managers with balanced mandates to a specialized asset class management style. Instead of each of our investment managers spreading our capital over three major asset classes, Inspirit would enlist specialized investment managers for each asset class to meet our financial, carbon, and impact goals.

In 2018, Inspirit launched a search for an investment manager for our public fixed income investments and eventually selected Addenda Capital. Specifically, we invested in Addenda’s Impact Fixed Income Fund as our public fixed income allocation of our portfolio. You can read about that process here.

A year later, a significant chunk of 2019 was dedicated to selecting an investment manager for our global equities asset class. The selection process was competitive, as we received more proposals than initially anticipated. Each proposal was assessed on five main criteria:

- Investment firm overview and their commitment to diversity, equity, and inclusion

- Proposed product overview, thesis, and fees

- Proposed product’s financial performance

- Proposed product’s carbon footprint performance

- Proposed product’s positive impact performance

After analyzing all submissions and two rounds of interviews with the final candidates, we were pleased to select CI Investments and their CI MSCI World ESG Impact Fund as the global equities allocation of our portfolio. The CI MSCI World ESG Impact Fund intrigued us for a number of reasons, specifically the fund’s projected financial performance, low carbon footprint, and strong positive impact. In addition to having relatively minimal carbon emissions, the holdings within the fund are all top performers along environmental, social, and governance metrics, and also earn a majority of their revenue through products and services that contribute to the outcomes of the United Nations Sustainable Developments Goals.

After allocating our global equities portion of our portfolio to the CI MSCI World ESG Impact Fund, 77% of our portfolio is now invested for positive impact.

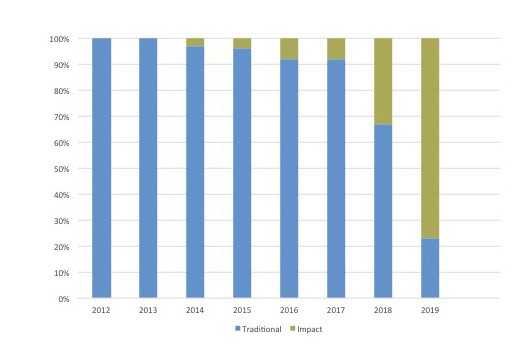

Inspirit’s Investment Portfolio: Traditional vs. Impact Investments

Figure 1: The progression of Inspirit’s investment portfolio from traditional investments to impact investments that align with Inspirit’s values.

What’s next

In order to earn higher financial returns and continue to aim for deep positive impact, in 2020 Inspirit will repeat the investment manager selection process, this time for Canadian equities. If all goes as planned, by the end of 2020, Inspirit will have reached our target of a 100% impact portfolio, while all our investments earn strong financial returns, produce a low carbon footprint, and generate deep positive impact.