Jory and Jill’s Impact Investing Journey: Part 16

By Jory Cohen, Director of Finance and Impact Investment

It’s been a while since my last post, partly because of market volatility, partly because of a need for cash, but mostly because my two young kids have this knack for making (my) time disappear. Despite the gap between the previous post in this impact investing blog series, the process of transitioning mine and Jill’s portfolio to be entirely composed of impact investments remains very much alive. As of now, all our investments generate positive social and environmental impact, but our cash.

Putting some of that cash to good work is the focus of this particular post, specifically our investment in the Honeytree U.S. Equity ETF, which has large cap companies based in the U.S. as underlying holdings. The ETF is housed within Honeytree Investment Management, an asset management firm with strategies focused on purpose-driven companies generating a net positive social and environmental impact. Paula Glick and Liz Simmie are the founders and owners of Honeytree, a rare investment management company owned and operated by women.

I first met Paula Glick in 2015 when she was working at MSCI, a global leader in investment data. At the time, Paula helped onboard Inspirit Foundation to the MSCI platform. A few years later in 2018, she teamed up with Liz Simmie to start Honeytree. If you’re curious, you can hear from Paula about how they landed on the name of their firm.

In 2023, Paula and Liz launched Honeytree’s first ETF—the product we recently invested in—with underlying holdings that are companies leveraging their impactful components of their businesses for long-term growth. At the time I’m writing this in July of 2024, some of the ETF’s largest holdings are Cummins, an alternative fuel engines and generator manufacturer, and Edwards Lifesciences, a medical technology supplier specializing in artificial heart valves and hemodynamic monitoring.

A requirement for every holding in the ETF is that at least a third of a company’s board needs to be composed of diverse members, which encompasses not just gender but also people of colour, LGBTQ+ individuals, and people with disabilities. While the Honeytree diversity floor is set at 33% now, Paula and Liz expect to raise the bar as time goes by to 40%, 50%, and maybe possibly beyond. Analysis of diversity isn’t confined to the board level, as metrics are measured throughout the company. There is enough data to be confident in the correlation between corporate diversity and profitability, which has demonstrated a direct relationship between an increased probability of financial outperformance with a higher rate of diverse representation.

Honeytree’s stock selection isn’t confined to standard environmental, social, and governance metrics only. Data from Glassdoor, an online community where workplaces are reviewed by employees, is incorporated into investment decision-making. As are parental leave policies, particularly paternity leave practices; not just the existence of the policy itself but the organizational encouragement for dads to take time off work to spend time with their babies.

Having been in roles at both MSCI and Sustainalytics (acquired by Morningstar), Paula brings a wealth of experience in ESG data and research. First at Sustainalytics she played a key role in developing the institutional ESG market in Canada, and then at MSCI Paula was key in building out ESG analytics and indexes. Of course, that’s incredibly valuable to the Honeytree investment process, but what I also discovered about Paula is that she’s an incredible violinist. Given she is the daughter of Srul Irving Glick, one of the most prominent and prolific composers in Canada, Paula’s musical talent is hardly surprising. Not only that, but she’s an avid chess player too.

While I don’t know Liz Simmie as well as Paula, I do know that Liz brings her quantitative portfolio management and compliance experience to Honeytree, which is very valuable to the partnership. Liz previously worked at Bristol Gate Capital Partners, a leading active management firm that employs tools like data science analysis and machine learning to build portfolios. At Bristol Gate she was at the core of a quick growth emerging manager, with assets under management skyrocketing into the billions from a bootstrapped model. Liz’s father, Peter Simmie, co-founded Bristol Gate in 2006, and I’ve heard Liz credit her dad and Bristol Gate with much of her quant-based skills. She also did quantitative market research for Ipsos, a global leader in that field. As an added bonus, she’s a self-professed dog lover.

According to a study conducted by the Knight Foundation, as of 2021 just 1.4% of assets under management in the United States were invested with firms owned by women or people of colour. That’s truly a depressing statistic and, making the safe assumption that the division of assets in Canada is similar to those of our neighbour, Honeytree is an example of why it is so important to the investment landscape. Paula and Liz are trailblazers in an industry historically and currently dominated by men–mostly white men–in leadership and ownership positions.

The Honeytree U.S. Equity ETF launched on November 6, 2023. Since inception until the end of the second quarter of 2024 (around the time I’m writing this), the ETF earned a 19.7% return. That’s quite the bump in value, especially compared to the 14.8% gain of the Dow Jones index–a common benchmark with 30 of the largest U.S. equities as holdings–the financial performance looks even stronger. Of course, this time period is a very limited sample size, but the ETF is definitely off to a good start.

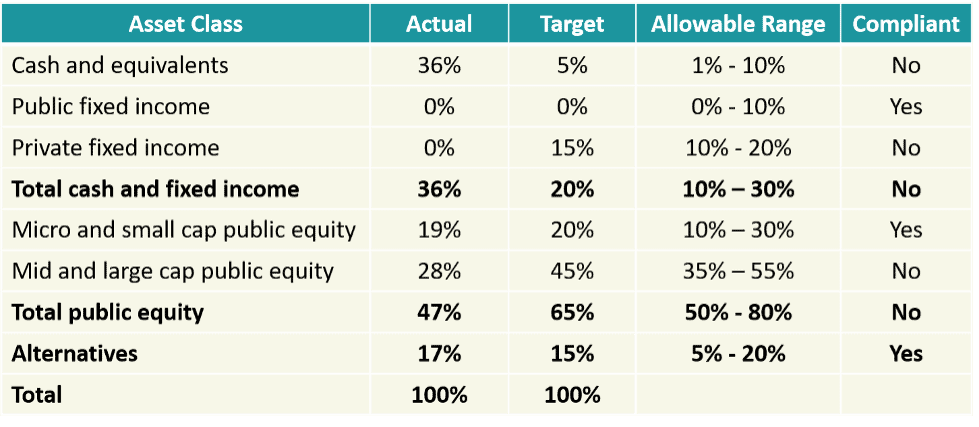

In terms of the effect on Jill and my portfolio, we have already transitioned our entire portfolio to impact investments with the exception of our cash. When considering our current asset allocation mix below, a couple of observations stand out. Even with the investment in the Honeytree ETF, our cash position remains overweight, private fixed income investing is non-existent at the moment, and the mid/large cap public equity asset class is underweight relative to its target. The last point is something we will consider in the next post in this series.

Paula and Liz are trailblazers in the investment management industry. Jill and I are excited to be a Honeytree investor and will continue to play a very small part in supporting a more equitable asset management sector.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice. Also, just so you know, I am not paid in any way by individuals, organizations, and investments who are featured in this blog. I don’t receive any benefits of any kind from individuals, organizations, and investments mentioned in this blog.