Jory and Jill’s Impact Investing Journey: Part 15

By Jory Cohen, Director of Finance and Impact Investment

Hayzen, our two-and-a-half-year-old son, has a tendency to ask Jill and I some interesting questions. The other day, he paused mid-activity as if he had an epiphany, looked squarely at both of us, and asked “What is love?” I stared blankly at this precocious toddler.

Something else Hayzen does is point to objects and ask, “Who made dis?” When he inquires about items like a staircase or a plant, I tend to stumble in my response. But when Hayzen pointed to a scarf purchased from Kotn, a sustainable apparel and homeware company, I immediately had an answer. Kotn, our newest investment, has been diligent in establishing an ethical and transparent supply chain for its products. I’ll dive deeper into this a little later in the post.

When Jill and I made our most recent investment in Fresh City Farms, I was convinced this would be the last big private investment for a while. Our contribution to Fresh City was a significant one (for us and our portfolio), so I didn’t think we would have the appetite to make another private investment for the foreseeable future. Then a friend and industry colleague of mine told me that Kotn was looking to raise some capital, and this was an opportunity we couldn’t pass up.

I first heard about Kotn in 2014 from Rami Helali, Co-Founder and CEO of the company. Actually, that’s when I initially heard the idea that eventually became Kotn. I still remember running into Rami in downtown Toronto. It had been a couple of years since we last saw one another. We went to university together and finished our undergrad in 2010. While Rami and I didn’t have that many classes together, we were certainly friendly and had mutual friends. So, when we ran into each other four years later, I was eager to catch up.

At the time, I was leading Youth Social Innovation Capital Fund, an impact investing fund dedicated to supporting young social entrepreneurs. Rami mentioned he was exploring the idea of perfecting a basic yet ethically-sourced cotton t-shirt. He was considering traveling to Egypt, where he spent a few years of his childhood, to contact smallholder cotton farmers. He asked me what I thought about his idea, and I remember saying, “I’m not an expert in ethical fashion, but it sounds promising to me.” Not a very helpful response but the next time I heard from Rami, he had returned from Egypt to launch Kotn.

Rami’s travels to Egypt weren’t solely driven by his family ties to the country. Egypt is known for producing the world’s best cotton (many would add “by far” to that claim). Egypt’s cotton is grown within the Nile Delta region since the river yields extremely fertile soil. Coupled with Egypt’s ideal agricultural climate, the country is famous for producing extra-long staple cotton, which is recognized for being soft and resilient. Longer fibres can be finely yarned while maintaining strength, resulting in material that’s incredibly soft and hardy. This type of cotton, which is hand-picked in Egypt, also tends to create lush and long-lasting fabric due to its ability to absorb colours.Rami spent about six months with a cotton-farming community within the Nile Delta region before returning to Toronto. Now, eight years later, Kotn is an established ethical apparel and homeware company with four physical store locations (with plans to expand) and millions in revenues. Beginning with an initial concept of perfecting a basic cotton t-shirt, Kotn has grown its offerings from a basic white t-shirt to apparel for all seasons, as well as merch and homeware.

We had the chance to speak with Rami about Kotn, social impact, and impact investing. Check out our Q&A with Rami Helali:

The company is committed to advancing sustainable, smallholder cotton farming. Cotton is sourced from independent farmers, emphasizing three simple, yet rare, supply chain principles: direct trade, guaranteed prices, and going organic. Kotn buys cotton directly from almost 2,400 smallholder farmers, cutting out any middle layers so farmers earn more (and customers pay less). The company also guarantees a purchase price to farmers, regardless of economic conditions, so there is no threat to income levels through cost reduction efforts. Unsurprisingly, within the next five years, Kotn is committed to sourcing exclusively certified organic natural fibers. However, the company won’t be leaving smallholder farmers behind; they’ll be working with their existing supply chain to assist farms in becoming more sustainable.

Kotn was told by farmers in the Nile Delta region about the need for access to education for children. That’s why, in partnership with a local not-for-profit, a portion of Kotn proceeds fund and build primary schools in the area. About 88% of the students enrolled in these schools are girls.

A company like Kotn doesn’t get built by a single person. Rami is one of three co-founders. The other two are Mackenzie Yeates and Benjamin Sehl. I won’t dive into their bios in this post, but I will mention that Mackenzie and Benjamin met through Rami, and now they’re married. Rami Helali: Co-Founder, CEO, and matchmaker!

The Kotn board of directors is currently composed of five members: Rami, Mackenzie, Benjamin, Alexandra Baillie, and Rostam Zafari. Both Alexandra (board chair) and Rostam represent two major investors in Kotn. While still small, it’s clear the composition of the board intentionally reflects Kotn’s inclusive organizational values, and I have no doubt Kotn’s equitable practices will continue to be reflected in the governance model moving forward.

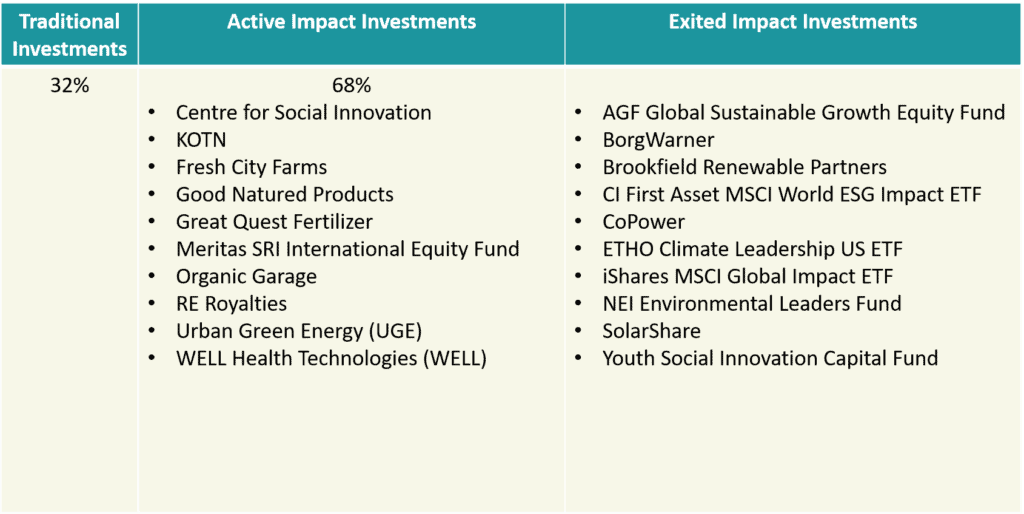

The investment in Kotn was a big one for Jill and I. Prior to this capital allocation, 47% of our portfolio could be considered impact investments. Including our allocation to Kotn, 68% of our portfolio has been transitioned to increase its impact.

The remaining 32% of our portfolio yet to be invested for impact is our cash. While almost all our cash right now is reserved for living expenses and a follow-on commitment to Fresh City, we may consider selling some of our public market holdings to free up more capital to make other investments—and quite honestly—to live. We’re exploring daycare options for Hayzen, and despite the recent national/provincial childcare agreement, daycare in Toronto is not quite $10/day yet.

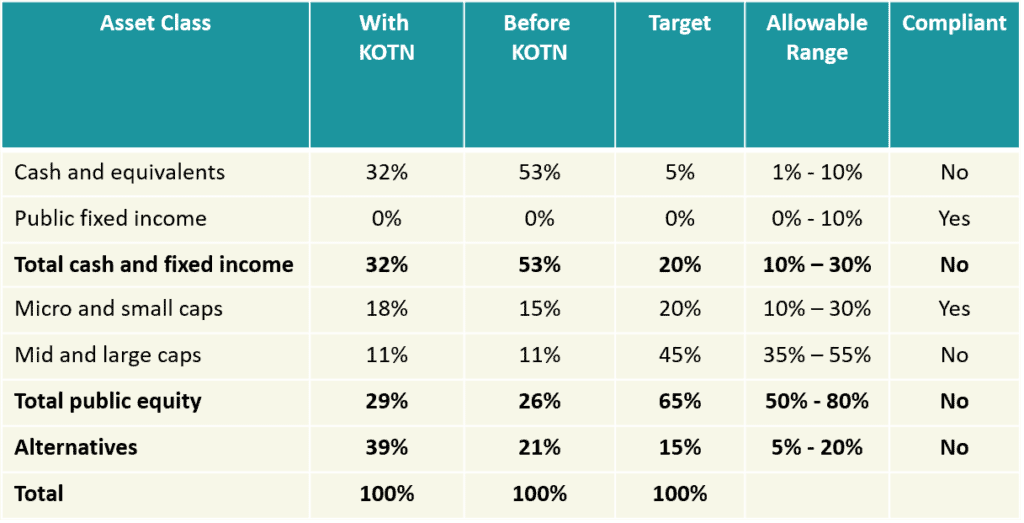

Looking at our asset allocation mix almost makes me laugh. Our commitment to alternatives is far beyond the target, and we have almost two-fifths of our portfolio locked up in two private investments (Fresh City and Kotn). This is certainly not a strategy I recommend to everyone (or anyone, really). I still encourage diversification, but now I just feel hypocritical doing so. It’s certainly less risky to listen to me than to mimic me!

As the pandemic and geopolitical struggles continue to dominate our lives in 2022, I thought I’d share a piece of artwork from Jill; it makes me reflect on 2021, and gives me a sense of peace (somehow). When Hayzen first saw this piece from Jill, he blurted out his favourite question: “Who made dis?” But then he answered his own question before we could. “Mama made dis,” Hayzen said, and then added, “Oh, it’s vewy nice.”

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice. Also, just so you know, I am not paid in any way by individuals, organizations, and investments who are featured in this blog. I don’t receive any benefits of any kind from individuals, organizations, and investments mentioned in this blog.