Jory and Jill’s impact investing journey: Part 12

As the pandemic drags on, life continues from home for my family. While I’ve been working from my home office, Jill’s been painting at the kitchen (turned art) table. A highlight for us during this period of isolation is that Jill decided to share her artwork publicly for the first time. Jill’s been painting the sky in watercolours – every single day in 2020 (and beyond). People have really resonated with the sky series, marking memories with a painted sky of that day. It’s been exciting to witness the launch of her site.

Source: www.jillyfrances.com

While I’d be more than happy to dedicate this entire post to Jill’s artwork, given the theme of this series, it probably makes more sense to tell you about our latest step in our 100% impact portfolio journey. This post will focus on our investment in Good Natured Products, a company that produces and distributes eco-friendly products and packaging made from plant-based materials.

I first heard about Good Natured back in May 2020. We invested in the company shortly after that and have subsequently added to the position since our initial investment. While our total cash investment in Good Natured has been relatively modest, the company’s stock has appreciated so much in a relatively short period of time that now the investment accounts for a fairly substantial portion of our portfolio.

I’ll go into more detail about the performance of Good Natured a little later, but first here’s a little more information about the company. Founded in 2006, Good Natured raised multiple rounds of private growth capital before going public on the TSX Venture Exchange in 2015. The ethos of Good Natured is to produce sustainable consumer goods that have the highest percentage of plant-based additives as possible. The company manufactures and distributes plant-based products, including compostable food containers and plant-based medical supplies packaging. The environmental issues related to traditional petroleum-based plastic are well known. Too much (way too much – probably north of 40%!) of petroleum-based plastic ends up in landfills (and oceans). Even if petroleum-based plastic is made to be recyclable, the lack of adequate recycling infrastructure forces plastic to be buried under ground (or water). Furthermore, petroleum-based plastic requires oil in the manufacturing process, which of course needs to be extracted from land. It’s clear petroleum-based plastics are environmentally unsustainable, and Good Natured is striving to provide products and packaging that are plant-based and biodegradable.

However, there is still environmental concern associated with more eco-friendly plastics. It’s true that plant-based plastics are biodegradable, but most bioplastics will only decompose under high temperatures in composting facilities. Current composting infrastructure cannot keep up with compostable supply, which results in organic waste ending up in landfills and releasing methane into the atmosphere. This lack of composting infrastructure is an issue that won’t likely be resolved soon, so it will be important to track Good Natured’s progress when it comes to innovating their products to replace petroleum-based plastics in order to generate the minimal environmental footprint possible.

In addition to monitoring the environmental risk associated with Good Natured’s potential positive impact, I’ll also be keeping an eye on the company’s approach to diversity and inclusion. Back in May 2020 I had the opportunity to ask Paul Antoniadis, CEO of Good Natured, about the company’s diversity and inclusion strategy. He assured me that Good Natured will grow their business through a lens of diversity and inclusion. Since then, the company’s senior leadership team has made visible progress along those lines, and I’ll certainly be keeping close tabs on the growth of the senior leadership group and the wider team too.

From a financial perspective, Good Natured is on a strong growth trajectory. Looking back on the past few years, annual revenue was around $2.5 million in 2017, $5.1 million in 2018, $10.1 million in 2019, and in the range of $16.4-$16.7 million in 2020 (the company released last year’s preliminary revenue figure but hasn’t finalized it yet). In December 2020, Good Natured acquired another company earning $17 million in annual revenue. Revenue certainly isn’t the tell-all indicator for growth and neither is stock price, but Good Natured’s share price rose over 400% in 2020 alone.

Good Natured’s significant increase in share price had a (positive) consequence for our portfolio, in the sense that a relatively small investment in the company has grown into a decent chunk of our assets. There are a couple other important changes to our portfolio. Back in 2019, we made an initial investment in UGE (Urban Green Energy), a company that develops, finances, and operates mid-scale commercial solar power systems (photovoltaic systems). Since then, we added to our initial position, and in 2020, UGE’s share price rose by over 1400% (yes, you read that right). As a consequence, our investment in UGE now accounts for a much more significant portion of our portfolio compared to when we made our initial investment back in 2019.

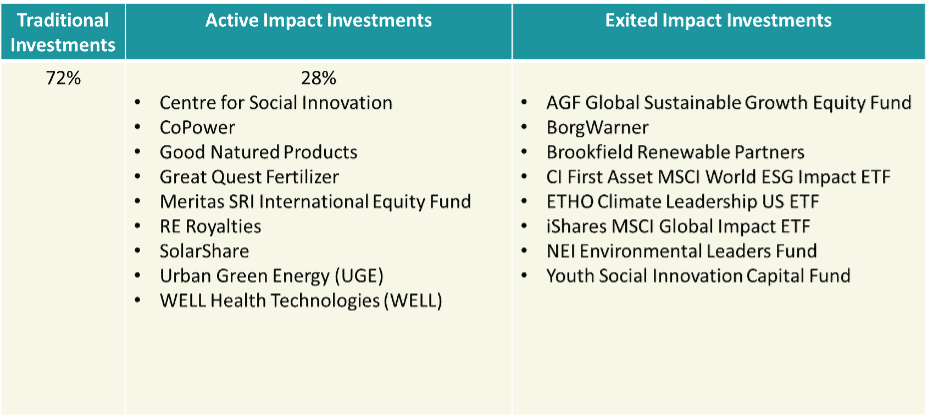

The other major development in our portfolio is that we sold our position in the CI First Asset MSCI World ESG Impact ETF, which is composed of global equity holdings with limited carbon footprint, strong performance along environmental/social/governance metrics, and a substantial portion of their revenue that contributes to the outcomes of the United Nation’s Sustainable Development Goals. This ETF has performed extremely well recently, so I thought it would be a good time to sell our position. Liquidating this investment at a healthy profit provides cash on hand to prepare for a private investment we’ll be making in the near future (details to come in future posts). As a result of these transactions – primarily due to the large position in the CI First Asset MSCI World ESG Impact ETF that we held – our portfolio’s proportion of impact investments relative to traditional investments decreased from 57% to 28%. Over time, the proportion of impact investments will increase once new opportunities are identified, but as of right now, below is a breakdown of our portfolio.

In addition to a rather unconventional decision to hold so much cash, I made an even more unconventional decision when it comes to our portfolio’s asset mix. The asset mix allocation our portfolio was modeling had relatively standard asset classes: cash and equivalents, public fixed income, private fixed income, Canadian public equity, global public equity, and alternatives (private equity, real estate, and infrastructure). The main issue with this asset mix is that, in practice, our portfolio wasn’t really considering public equities through a geographic lens. Instead, public equities were differentiated by size of market cap. Given that, I substituted the public equity asset classes that were based on geography with market cap identifiers – ‘nana, micro, and small cap’ replaced Canadian public equity, while ‘mid, large, and mega cap’ replaced global public equity. For reference, cap size is defined below:

- Nano cap: < $50 million

- Micro cap: [$50 million – $300 million[

- Small cap: [$300 million – $2 billion[

- Mid cap: [$2 billion – $10 billion[

- Large cap: [$10 billion – $200 billion[

- Mega cap: > $200 billion

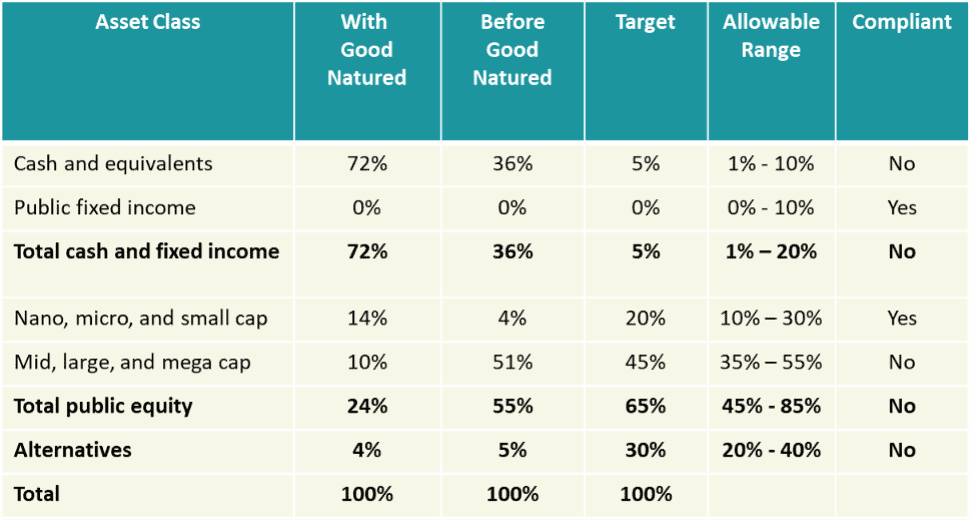

The other change to our portfolio’s asset mix is that private debt has joined the alternatives section, so the alternatives asset class now includes private debt, private equity, real estate, and infrastructure. Using our new asset allocation mix, below is how our portfolio looked before and after our investment in Good Natured, the added position in UGE, and the sale of CI First Asset MSCI World ESG Impact ETF. For reference, both Good Natured and UGE are micro caps, while the CI ETF holds large and mega caps.

The real standout here is the amount of cash on hand, which is the majority of our portfolio right now. Due to the excess of cash, our portfolio is way out of line compared to our asset mix targets. I’m fine with this for now, but over time I’ll be putting that cash to good use through new impact investments.

As I continue to monitor our portfolio, I have the pleasure of witnessing Jill create and share her artwork. Her art has been a welcome refuge for us and others this past year, and I know it will continue to be as we all navigate through uncertainty of the pandemic.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice.