Part Eight of Jory and Jill’s Personal Impact Investing Journey

Just when my wife Jill and I were almost halfway towards our goal of a 100% impact portfolio (see previous post), we liquidated a significant chunk of our portfolio to buy a house!

The home purchase was fueled by some happy news for us: a baby! We welcomed Hayzen Marty Cohen into our new home in October 2019. Coming home with Hayzen for the first time was the most special feeling and made our new house feel like a home.

While we’re thrilled with our new home, our investment portfolio is now all out of whack, specifically in terms of our desired percentage of portfolio split between impact investments versus traditional investments and as a result our asset allocation mix . There will be more on this later on in the post.

Back in 2014, we bought a condo in downtown Toronto. Our condo building, called the Merchandise Building, was originally built in 1910. It served multiple purposes throughout the years; first, a Simpson’s department store and then a Sears Canada warehouse, the building was eventually converted into residential lofts in 2000.

We were thrilled to live there, but once news of the baby arrived, we wanted to live a little outside the downtown core and in a house if possible.

Due to the surge in real estate prices in Toronto over the past five years, particularly when it comes to condos, Jill and I were able to sell our place at a healthy profit, liquidate all the investments we could (again, at a healthy profit), and secure a new home a little north of downtown in March 2019.

The exterior of the Merchandise Building, located in downtown Toronto

Source: Our real estate agent’s photographer

Our condo was the first piece of property that Jill and I owned. That means the government does not consider us first-time home buyers anymore, so we couldn’t access the Home Buyer’s Plan offered to purchase our new home. The Plan allows residents of Canada to withdraw up to $25,000 from their Registered Retirement Savings Plan (RRSP) to help finance the purchase of their first (and only first) property.

For our American friends, RRSP accounts in Canada are akin to 401(k) plans in the U.S. Given that Jill and I didn’t qualify for this program for the purchase of our house, and that there would have been a penalty to make early withdrawals from our RRSP accounts before retirement age, we left those accounts intact.

Along with a mortgage, we used capital from liquidated investments held within our Tax-Free Savings Accounts (TFSA), to bridge the gap between the cost of our new house and the proceeds earned from the sale of our old condo.

The TFSA allows earned investment income to be tax-free, even when the taxpayer withdraws it. That goes for both interest/dividend income and capital gains. Canada’s TFSA has similar characteristics to the Roth IRA in the States.

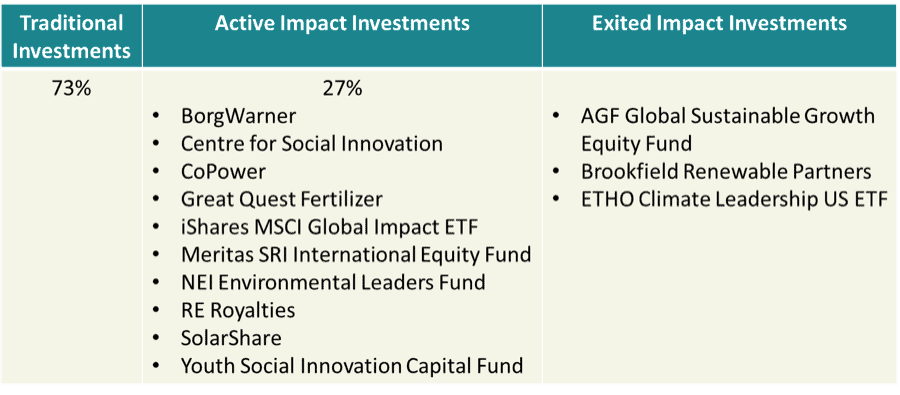

It was necessary to liquidate our TFSA accounts to help finance the purchase of our home. However, our portfolio allocation to impact investments decreased to 27%, a steep decline from the 49% allocation achieved previously.

You’ll notice a list of exited investments in the right-hand column of the table below. I’ll continue to track exited investments as maturities and liquidations occur throughout our 100% impact portfolio journey.

While it may seem that the bulk of our portfolio is now in traditional investments, it turns out that the majority of our portfolio is sitting in cash. For the table above, allocation to traditional investments includes cash.

We’re holding cash because, at first, we liquidated all the investments we could to purchase our home. Now we’re carrying some excess cash to help with expenses related to furnishing our home and caring for Hayzen. Babies aren’t just cute, they’re expensive too!

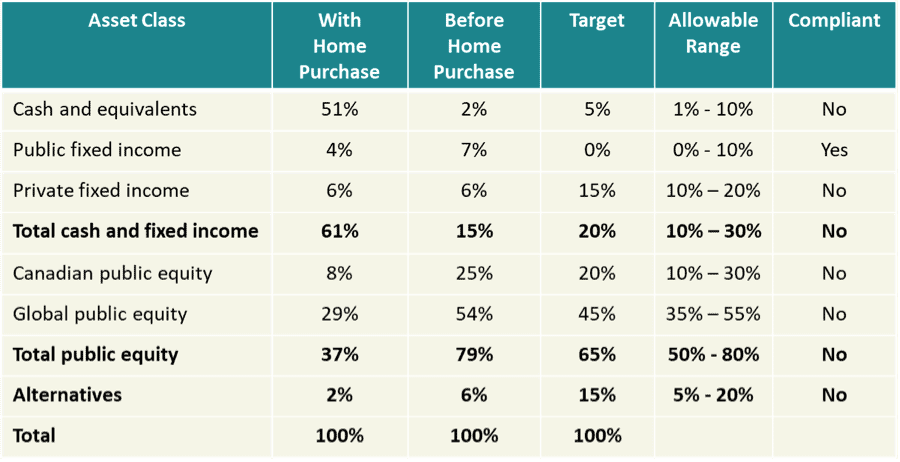

The next few posts will focus on re-balancing our portfolio to stay within the targeted asset allocation ranges listed below, but here’s how our asset mix looks like as of June 2019.

Over the next little while we’ll be putting that excess cash to good work in the form of impact investments that help us align with our target asset mix listed above. In the meantime, we’ll continue to settle into our new home as a family of three!

[mk_divider style=”shadow_line” margin_top=”20″ margin_bottom=”20″ el_class=”our-priority”]

Be sure to read Part 1, Part 2, Part 3, Part 4, Part 5, Part 6 and Part 7 of Jill and my personal impact investing journey.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice to find out what works best for you.