Part Five of Jory and Jill’s Personal Impact Investing Journey

by Jory Cohen, Director of Social Finance and Investment

After writing about two public equity impact investments in the previous post (iShares MSCI Global Impact ETF and ETHO Climate Leadership US ETF) that intentionally invest in many companies across various sectors, this post focuses on a single investment in one individual public company only: Great Quest Fertilizer Inc. Generally speaking, I tend to shy away from holding direct equity positions in individual public companies because I don’t consider myself an expert in picking stocks. While I do have a healthy amount of experience investing directly in private companies through my professional roles at the Inspirit Foundation and Youth Social Innovation Capital Fund, I have less experience investing directly in individual public companies.

For that reason, our investment in Great Quest Fertilizer might seem a little out of our comfort zone. However, although technically a public company, for the purposes of our portfolio we’re going to treat Great Quest Fertilizer as an alternative investment with similar characteristics to a private equity investment. Even though Great Quest Fertilizer is a publicly-listed company on the TSX Venture Exchange, my assessment of the company showed that this investment opportunity shares similar characteristics to many private investments I’ve seen before. These characteristics include the relatively high risk of failure of a company in early stages of operations, possible investment illiquidity, and potential for a big financial and impact upside.

Before we get too deep into the characteristics of the investment, here’s an overview of the company: Great Quest Fertilizer’s activities are very much aligned with the United Nations Sustainable Development Goal around sustainable agriculture and food security. Great Quest Fertilizer develops high quality fertilizer that increases agricultural yields and stabilizes food systems. The company develops affordable farm-ready fertilizers for agricultural markets in West Africa. It currently focuses on Mali where much of the fertilizers used there are imported into the country, resulting in relatively high fertilizer prices for local farmers. By operating within Mali, Great Quest Fertilizer produces relatively affordable fertilizers of higher quality.

Great Quest Fertilizer operates a phosphate deposit in Mali. Phosphorous, a chemical element found in high quantity in naturally occurring apatite mineral and a key ingredient in fertilizer, is important for the healthy growth of crops and plants. Great Quest Fertilizer is developing a phosphate deposit that originates from a prehistoric sea floor environment that is now dry and part of the Sahara Desert. The type of phosphate deposit operated by the company, which is sedimentary (rock) in nature, are rare. Some deposits can be found on the coasts of North Africa (Morocco) and the US (Florida), but generally speaking, these deposits are globally few and far between. It is an uncommon situation to find this type of deposit in an area that has a growing need for the nutrient. Phosphate is a non-renewable and limited resource crucial to the effectiveness of high quality fertilizer.

I’m not an expert when it comes to agriculture and fertilizer, but President and CEO of Great Quest Fertilizer, Jed Richardson, is. He is an accomplished businessman, holds a degree in Mineral and Geological Engineering and has decades of experience in the capital markets. While Jed’s credentials are indeed impressive, Jill and I also know Jed personally. He is a dedicated husband and father, and a generous friend. He’s someone we’re comfortable and proud to support, especially when Jed’s operating within his field of expertise.

Nevertheless, an investment in Great Quest Fertilizer remains a risky one because this is an early stage company that may not reach its financial and operational targets. Furthermore, an investment in Great Quest Fertilizer has the potential to be illiquid – we would only be able to sell our stocks in the company if there are buyers at the other end. It’s hard to predict if buyers will flock to Great Quest Fertilizer at the time we may want to liquidate some or all our shares. As a result, we classify this investment as a relatively illiquid investment. The flip side to the riskiness of the company being relatively early stage and the asset being possibly illiquid is the potential financial and impact upside of the investment. At the time of our purchase in early 2018, a share in Great Quest Fertilizer was valued around $0.15 or so. Considering shares were once valued over $4.00 in 2011, there’s ample room for growth in share value.

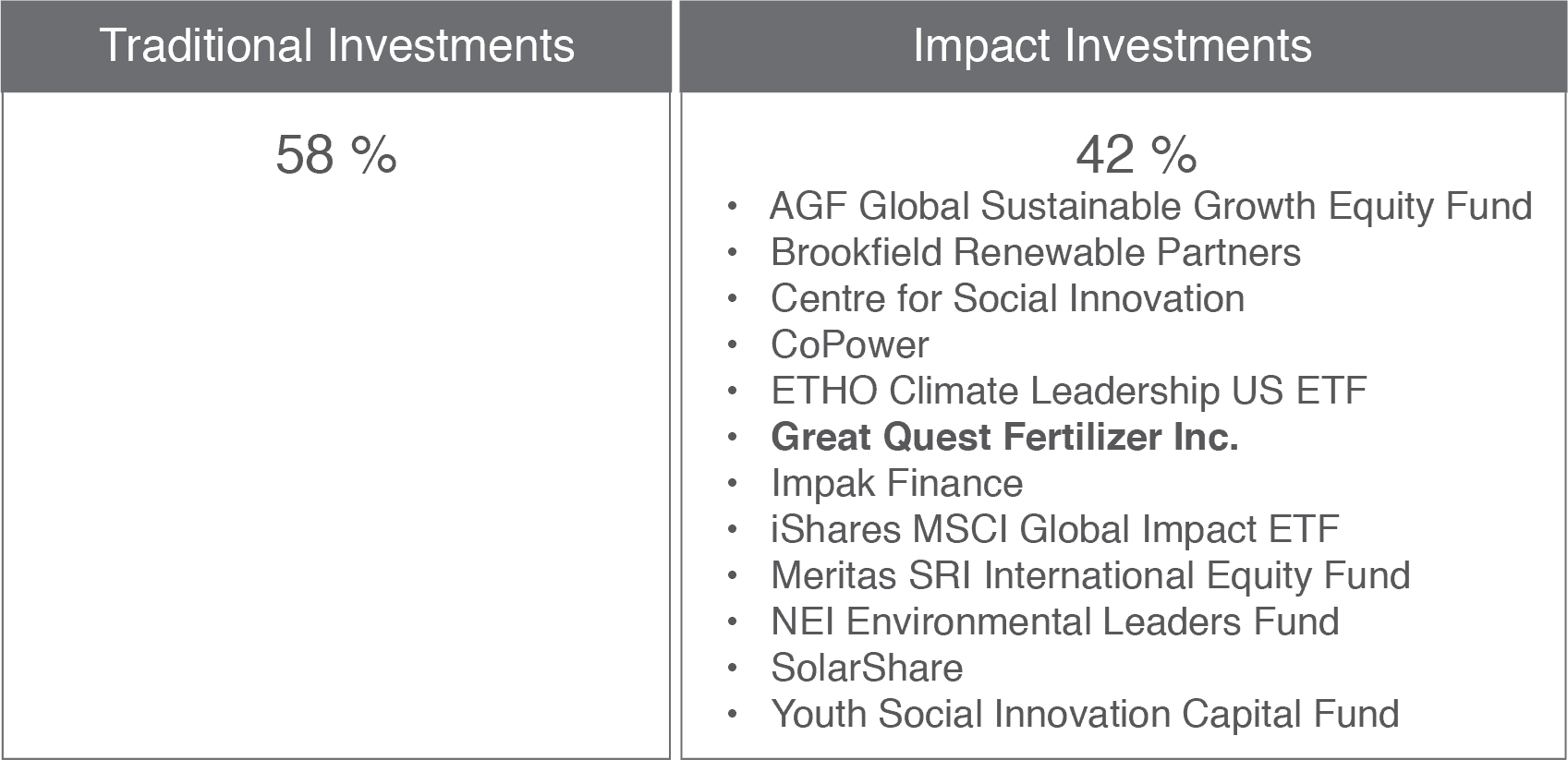

Prior to our investment in Great Quest Fertilizer, 41% of our portfolio was allocated to impact investments. Given the risk exposure of the investment, our allocation here was a modest one, bringing our allocation to impact investments to 42% of our portfolio:

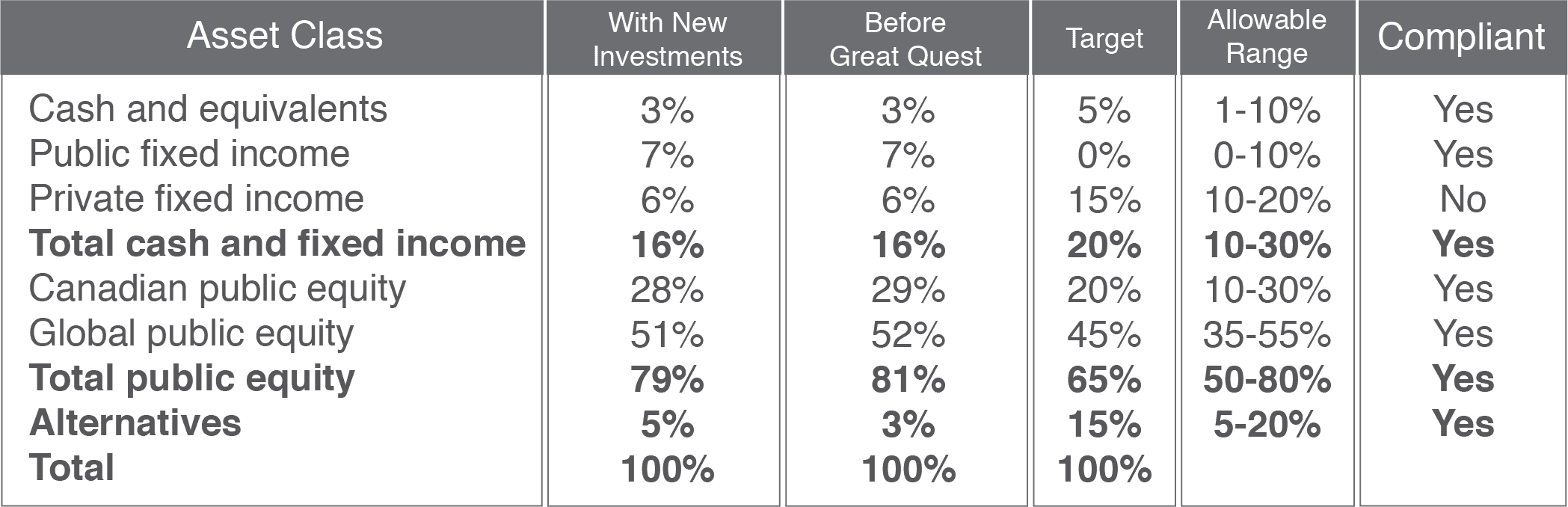

As for the asset allocation mix of our portfolio, Great Quest Fertilizer doesn’t affect it too much beyond adding some weight to the alternatives portion of our portfolio:

While Great Quest Fertilizer is a small allocation of our portfolio and carries significant risk, in our opinion it also holds big potential upside in financial and impact returns. Be sure to read Part 1, Part 2, Part 3 and Part 4 of Jill and my personal impact investing journey.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice to find out what works best for you.