Part Four of Jory and Jill’s Personal Impact Investing Journey

by Jory Cohen, Director of Social Finance and Investment

Last year, my wife Jill and I committed to a personal 100% impact portfolio where we leverage our assets for positive social and environmental impact by aligning our investments with our vision of how we want the world to be. For us, that means investing in companies that are top performers along environmental, social and governance metrics and that contribute to the United Nations’ Sustainable Development Goals.

This is the fourth post in a series documenting our journey as we transition our portfolio from one with mostly traditional investments–which don’t intentionally create positive social or environmental impact–to one composed entirely of impact investments.

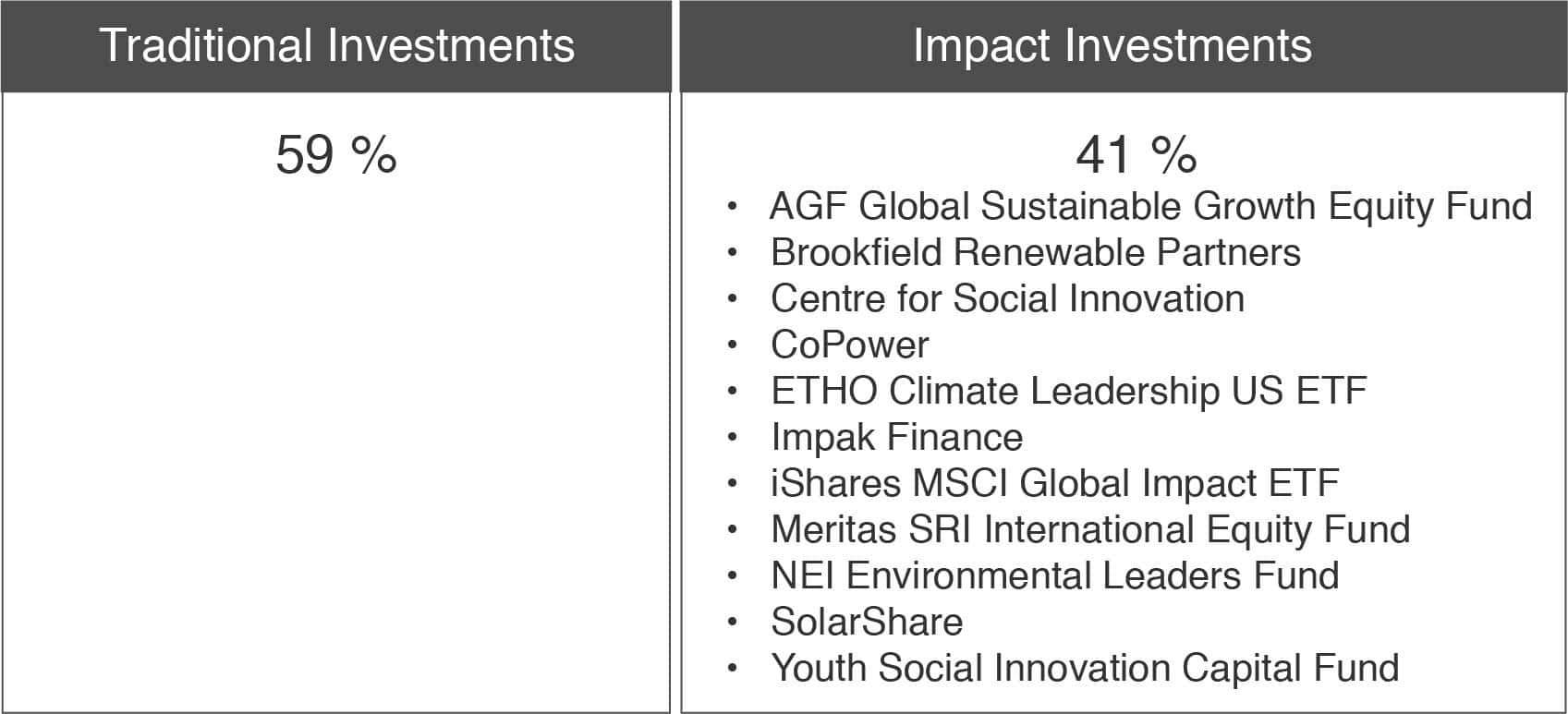

The previous post in this series talked about investing in three public equity impact investments: the NEI Environmental Leaders Fund, the AGF Global Sustainable Growth Equity Fund and the Meritas SRI International Equity Fund. All three of these investments are actively managed mutual funds, which means that investors in these funds trust management teams to actively buy and sell holdings in order to increase their performance over time. This active approach to investing comes at a cost: management expense ratios are the fees paid by investors to invest in the funds. While almost all investments have management expense ratios, actively managed investments tend to have a higher cost to investors than passively managed ones, which tend to limit transactions like buying and selling to only once or a few times per year. Since passively managed investments require less active buying and selling, not to mention limited overhead expenses, their management expense ratios tend to be lower than actively managed investments. You can learn more about the differences between active and passive investing here.

In an attempt to lower the costs associated with our portfolio, we invested in two passively managed exchange-traded funds, or ETFs, which tend to track indexes and carry low fees to investors. We invested in two global public equity ETFs: the iShares MSCI Global Impact ETF and the Etho Climate Leadership U.S. ETF.

The holdings in the iShares MSCI Global Impact ETF earn a majority of their revenue from products and services that contribute to the United Nations Sustainable Development Goals. These holdings are also screened along environmental, social and governance metrics and tend have a smaller carbon footprint compared to the holdings in traditional benchmarks like the MSCI ACWI Index. The holdings in the iShares MSCI Global Impact ETF are selected based on financial criteria and positive social and environmental impact performance. Here’s a link to MSCI’s holding selection methodology. While the performance history of this ETF is limited – it only launched in 2016 – at the time of writing (February 2018), its financial performance since the iShares MSCI Global Impact ETF began has outstripped the benchmark MSCI ACWI index in that same time period.

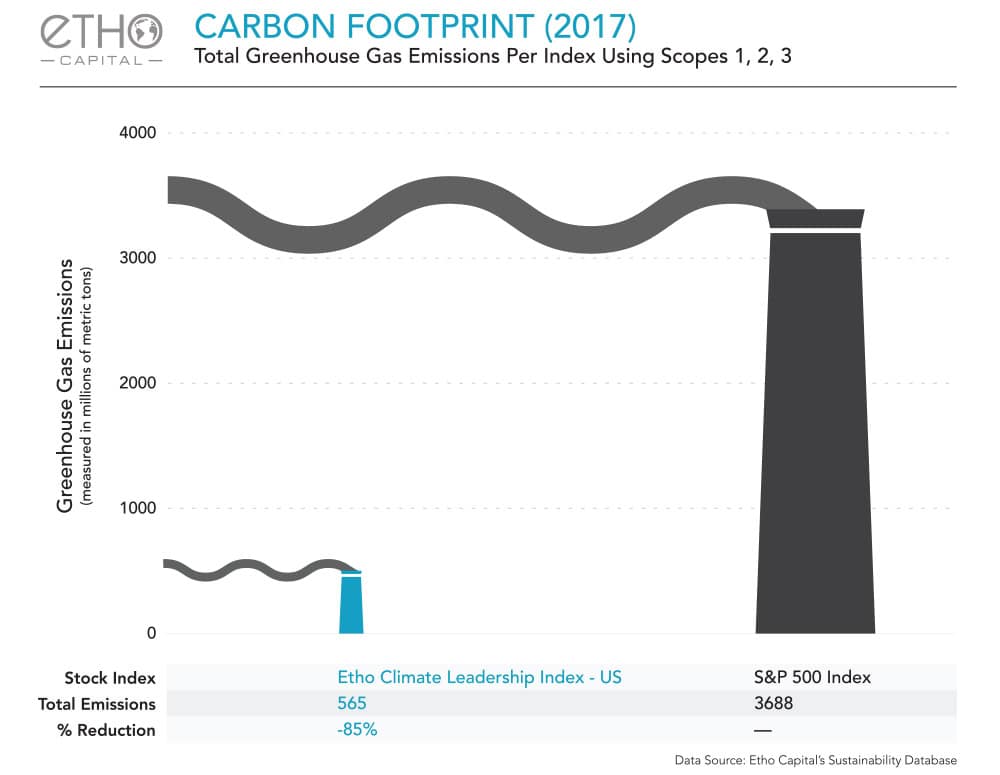

The Etho Climate Leadership U.S. ETF identifies holdings that are the most carbon efficient compared to their industry peers. The idea is that carbon efficiency leads to higher long-term profitability, an investing approach that has led this ETF to outperform benchmarks like the S&P 500 since its creation, as of the time of writing (February 2018). The holdings in this ETF tend to be at least 50% more carbon efficient than their respective industry averages and also tend to have the smallest carbon footprint in their respective industries. Holdings in this ETF are screened for environmental, social and governance performance as well, and the ETF stays away from specific companies and even entire industries that are identified as bad actors or stewards (tobacco, guns, gambling, etc.). Here’s a little more information about the holding selection criteria. Before making investments in these two ETFs, 19% of our portfolio was allocated to impact investments. With these two new investments, that figure increases to 41%. We were comfortable allocating a good portion of our portfolio to these ETFs because they have a history of tracking and financially outperforming their benchmarks while also intentionally investing for positive social and environmental impact.

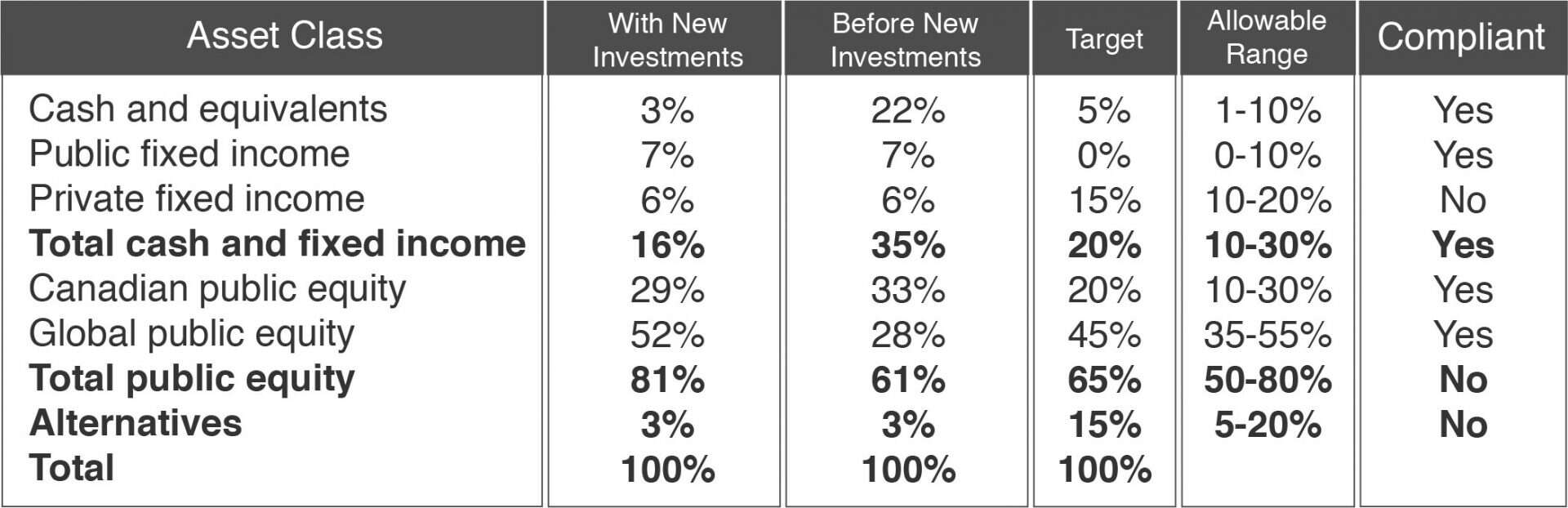

In terms of the different types of assets in our portfolio, we essentially used almost all the cash we had on hand to make these two investments. Prior to these new investments, we had fewer global public equities than we would have liked, however we’re now within our desired range for global public equities and even a little north of our target allocation.

In general, the more passive and low-cost approach to public market investing is attractive to our portfolio. We hope that an impact-driven ETF with mostly Canadian holdings will be launched in the market in the near future. If you’re working on developing one, I’d love to hear about it so do get in touch. Be sure to read Part 1, Part 2 and Part 3 of Jill and my personal impact investing journey.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice to find out what works best for you.