Part Seven of Jory and Jill’s Personal Impact Investing Journey

Published May 27, 2019 | By Jory Cohen, Director of Social Finance and Investment |

This post focuses on the next step in the series describing the steps my wife, Jill, and I are taking to reach a 100% impact portfolio: our investment in RE Royalties, a publicly-traded company in its early stages of operations. Due to the company’s initial stage of growth and relatively small size (market capitalization), I viewed its risk/return profile as comparable to some of the private investments I’ve made in the past, both personally and throughout my professional career. That’s why I classified the investment in RE Royalities within the alternatives asset class, which includes private equity investments. The same can be said about Great Quest Fertilizer which I discussed in a previous post—both investments share similar risk and return characteristics.

RE Royalties is a newly-founded company listed on the TSX Venture Exchange that provides financing to renewable energy projects in return for a percentage of the project’s revenues moving forward. As of March 2019, RE Royalties has financed 11 projects to date—six solar parks, two wind farms, and three hydro plants—in exchange for a percentage of those project’s future revenues. These projects have a combined production capacity of almost 500 MegaWatts of electricity per year, which is equivalent to powering a conservative estimate of over 100,000 homes annually. As RE Royalties grows its operations, the company will continue to finance more clean energy projects in return for a share of the future generated revenues.

RE Royalties employs a financial instrument called revenue-based financing, which allows companies to raise capital while maintaining ownership of their projects. Revenue-based financing is a non-dilutive financial instrument, meaning it allows the owners of ventures to raise funding while keeping their ownership stakes in their projects. I’m familiar with revenue-based financing due to my time leading the Youth Social Innovation Capital Fund, which provides loans to companies that are repaid based on the revenues of the supported ventures. You can read about how Youth Social Innovation Capital Fund does revenue-based financing here.

RE Royalties was founded by Bernard Tan and Peter Leighton. Both Bernard and Peter have considerable professional experience – Bernard as a chief financial officer in the mining industry and Peter as a chief operating officer of a company in the wind energy sector.

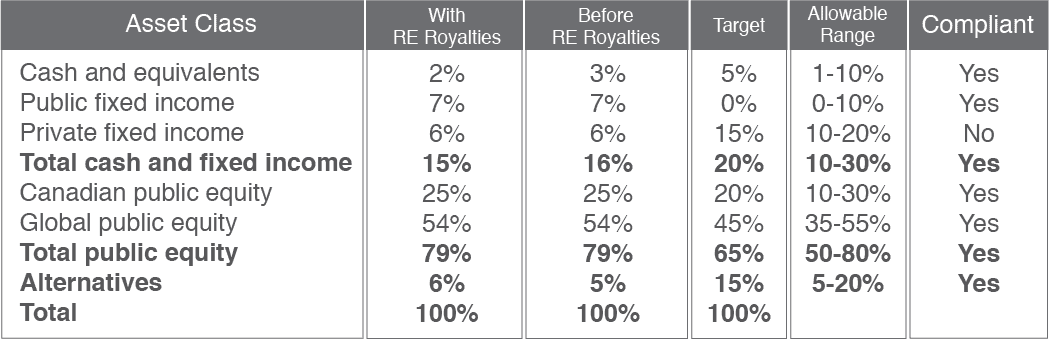

Jill and I decided to allocate a very small percentage of our portfolio to our investment in RE Royalties. Due to my perceived risk level associated with the company given its relatively small size and in its early stages of operations, our allocation to RE Royalties from a portfolio perspective is minimal. Since I consider the risk profile of RE Royalties to be more like a private equity investment, even though it’s publicly-listed on the TSX Venture Exchange, the company adds a little weight to our alternatives asset class. See Table 1 below:

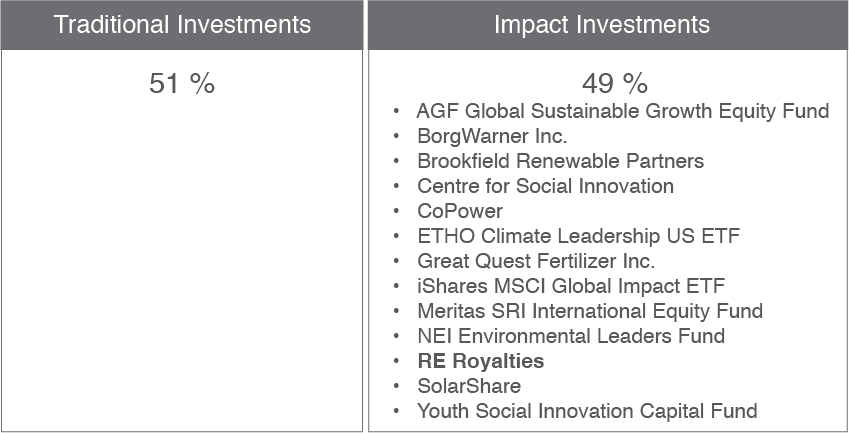

Prior to our investment in RE Royalties, 48% of our portfolio was allocated to impact investments. With RE Royalties, 49% of our portfolio is considered to be impact investments as shown in Table 2 below:

Stay tuned for the next post as it will be atypical for this series. The next post will outline what happens to our portfolio after Jill and I bought a house. Here’s a hint: our investment portfolio looks a lot heartier (and healthier) in this post than it does in the next one!

[mk_divider style=”shadow_line” margin_top=”20″ margin_bottom=”20″ el_class=”our-priority”]

Be sure to read Part 1, Part 2, Part 3, Part 4, Part 5 and Part 6 of Jill and my personal impact investing journey.

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice to find out what works best for you.