Part Three of Jory and Jill’s Personal Impact Investing Journey

by Jory Cohen, Director of Social Finance and Investment

This is the third post in a blog series about how my wife Jill and I committed to a personal 100% impact portfolio where we attempt to align all our investable assets with our vision of how we want the world to be. In my previous post I wrote about how we invested in two private fixed income impact investments: SolarShare and CoPower. This post focuses on three public equity impact investments in NEI Environmental Leaders Fund, AGF Global Sustainable Growth Equity Fund, and Meritas SRI International Equity Fund.

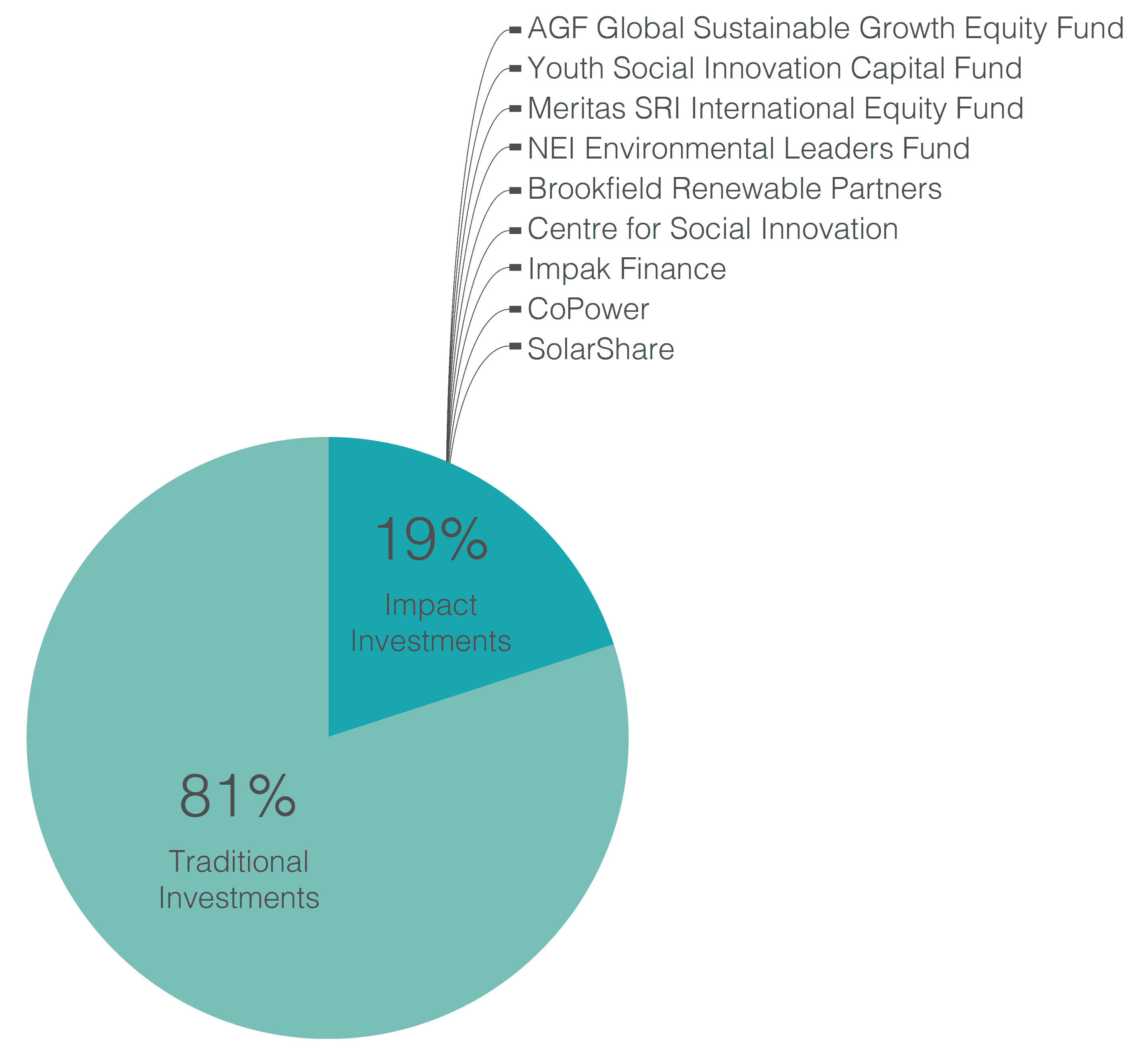

In the first post of this blog series, I defined a framework that classifies our investments into two distinct categories: traditional investments and impact investments. Impact investments are investments in companies that are top performers along environmental, social, and governance metrics. Ideally, these companies should also earn at least 50% of their revenue by contributing to the outcomes of the United Nations Sustainable Development Goals.

Of the three public equity funds that we invested in, all three select companies that are top performers along environmental, social, and governance metrics. Additionally, both NEI Environmental Leaders Fund and AGF Global Sustainable Growth Equity Fund also intentionally invest in companies that earn a significant amount of their revenue by contributing to the desired outcomes of the United Nations Sustainable Development Goals, particularly goals around clean water and sanitation, affordable and clean energy, and climate action.

Prior to these three investments, 9% of our portfolio was allocated to impact investments. Inclusive of these three new investments, that figure increases to 19%.

Here’s a little more information about each of the three new investments.

NEI Environmental Leaders Fund

NEI Environmental Leaders Fund invests in companies whose primary business contributes to environmental solutions in the water, clean energy, waste management, and sustainable food and agriculture sectors. In order for a company to be considered as an eligible holding in the fund, it must be a top performer along environmental, social, and governance metrics. Eligible companies must also earn a significant amount of their revenue from products and services that positively contribute to one or more of the above environmental sectors.

NEI Investments is the investment manager that offers this product in Canada, although the fund is actually managed by a British investment firm called Impax Asset Management. If you find the performance track record of the NEI Environmental Leaders Fund to be limited, it’s because NEI Investments only began to offer this product in Canada in early 2016. That being said, the Impax Asset Management fund has been operating in the United Kingdom since 2002, so that could provide a reasonable longer-term performance outlook on the NEI Environmental Leaders Fund.

AGF Global Sustainable Growth Equity Fund

AGF Global Sustainable Growth Equity Fund invests in companies that are top performers along environmental, social, and governance metrics and that operate within the sectors of clean energy, waste management and pollution control, water and waste water solutions, and health and well-being. The underlying holdings within this fund must earn a significant amount of their revenue by positively contributing to the above sectors. While this fund was first offered in 1991, it only shifted its mandate from a Canadian focused fund to a global equity fund at the beginning of 2015. When assessing performance history, it may be best to only consider results starting in 2015 since that was the point when the fund transitioned to one focused on global equities.

Meritas SRI International Equity Fund

Meritas SRI International Equity Fund applies environmental, social, and governance screens when assessing the investment worthiness of a company. The fund invests in best-in-class performers along those screens, ensuring that each company the fund invests in is managed fairly and responsibly. While the fund doesn’t explicitly state that it only invests in companies whose primary business contributes to the objectives of the United Nations Sustainable Development Goals, a look at the fund’s holdings leads me to believe that a good chunk of these companies earn significant portions of their revenue through products and services that generate positive social and environmental impact.

We purchased the Meritas SRI International Equity Fund through the Group Retirement Savings Plan generously offered by my employer, the Inspirit Foundation. I found this fund to be the most geared toward achieving positive impact relative to the available products on the Group Retirement Savings Plan. As I continue to be fortunate enough to work at Inspirit, our personal allocation to the Meritas SRI International Equity Fund will increase with my salary earnings.

Before diving into how these new investments affect our portfolio allocations, it’s worth spending some time on one of the potential downsides of these investments: the fees! The three funds we invested in are professionally managed, which is an approach to investing that relies on the managers of these funds to actively buy and sell holdings at their discretion. This active investment approach depends on the managers’ savvy analysis and trading (and luck!) to financially outperform a benchmark like the MSCI ACWI Index.

While professional management can prove useful, it also comes at a cost in the form of a management expense ratio, which is the percentage of a fund’s assets allocated to cover the fund’s expenses. At the time we released this post in late November 2017, the management expense ratios for the three funds we invested in were:

- NEI Environmental Leaders Fund: 2.42%

- AGF Global Sustainable Growth Equity Fund: 2.63%

- Meritas SRI International Equity Fund: 2.96% (we got a lower fee through Inspirit’s Group RSP)

That means that for those funds to financially outperform their benchmarks, they need to do so after subtracting their fees. Their gross returns need to be high enough that their net returns are still above the benchmark returns.

For example, in a hypothetical given year the NEI Environmental Leaders Fund might earn a gross 10% return and is measured against a benchmarked return of 5%. Using the management expense ratio noted above, NEI Environmental Leaders Fund’s net return is 7.58% (10%-2.42%). In this hypothetical scenario, the NEI Environmental Leaders Fund financially outstripped the benchmark.

It should be noted that this simplified cost analysis only considers the financial perspective of an investment and not the impact performance. It’s also worth pointing out that the above fees are for retail investors (every day individuals). Fees tend to decrease for bigger, institutional investors like pension funds, foundations and endowments, etc.

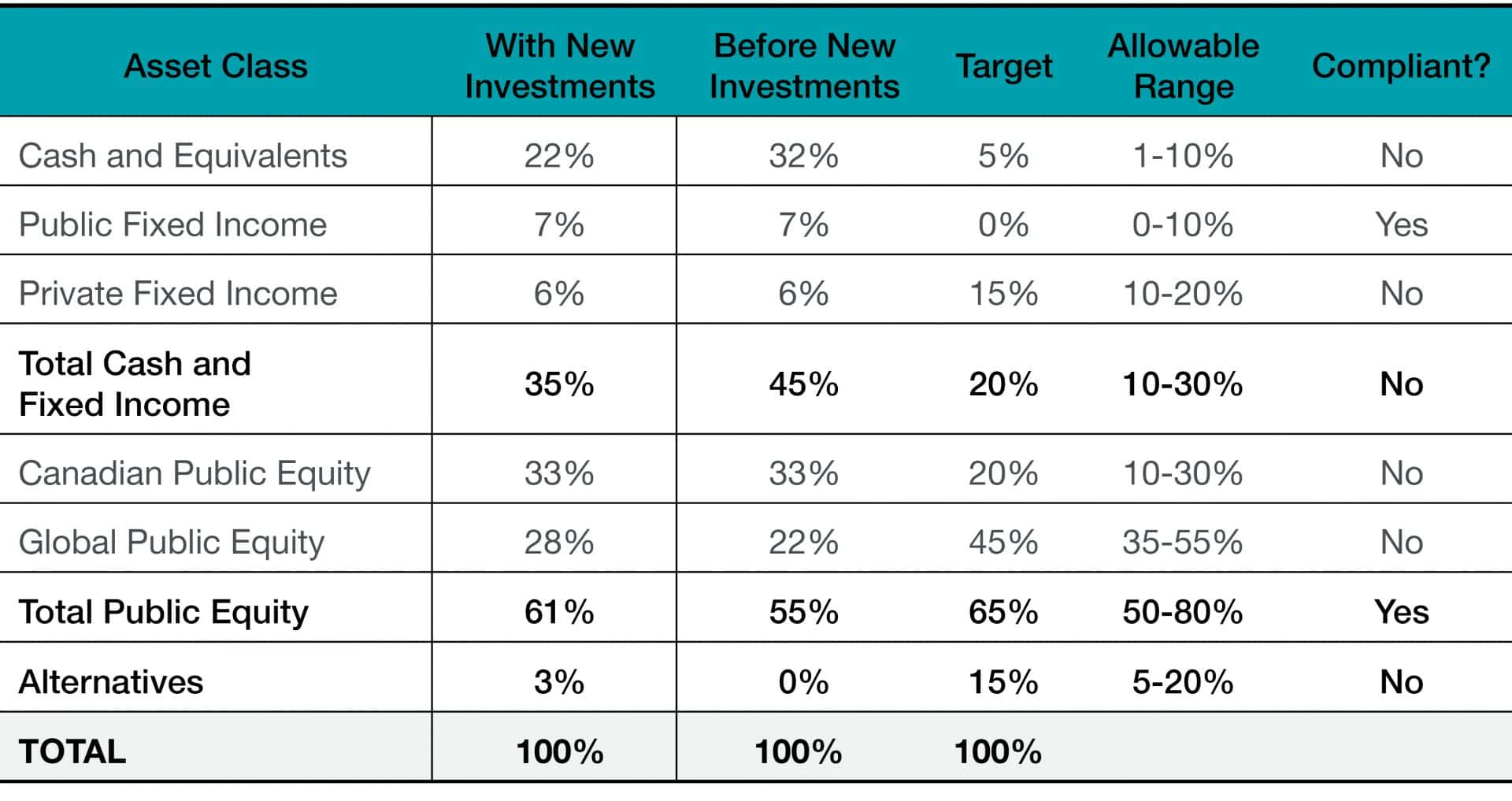

All three of these funds primarily invest in global public equities, meaning that the companies within the funds are not Canadian. We intentionally invested in global public equities funds because we were underweight in the global public equities asset class. Here’s how our asset allocation mix looks as at April 30, 2017.

One thing to note here is that our allocation to alternatives increased without any mention of a new investment in this asset class. While we didn’t make a new alternative investment, we did re-categorize our investment in Brookfield Renewable Partners, one of the largest independent renewable power businesses in the world. Prior to this post, this investment was categorized as a global public equity when it actually more closely resembles an alternative investment in sustainable infrastructure.

Be sure to read Part 1, Part 2 and Part 4 of Jill and my personal impact investing journey.

Disclaimer: This blog post is not investment advice nor an investment recommendation. Please seek independent professional investment advice.