Impact Investing and the Pandemic: Part 7

By Jory Cohen, Director of Finance and Impact Investment, Inspirit Foundation

Over the past couple of years, we’ve experienced the ebbs and flows of pandemic waves. The same is true for the financial markets. While last year produced peak performance, we’re now facing a steep valley in 2022. Inspirit Foundation’s portfolio is not immune to market forces. Like most other investors, our portfolio has experienced significant challenges this year. However, compounding a down market is the fact that, similar to 2021, Canada’s energy sector is the highest performing in the market. Since Inspirit is committed to impact investing and a 100% impact portfolio with low carbon exposure, we were bracing for negative results.

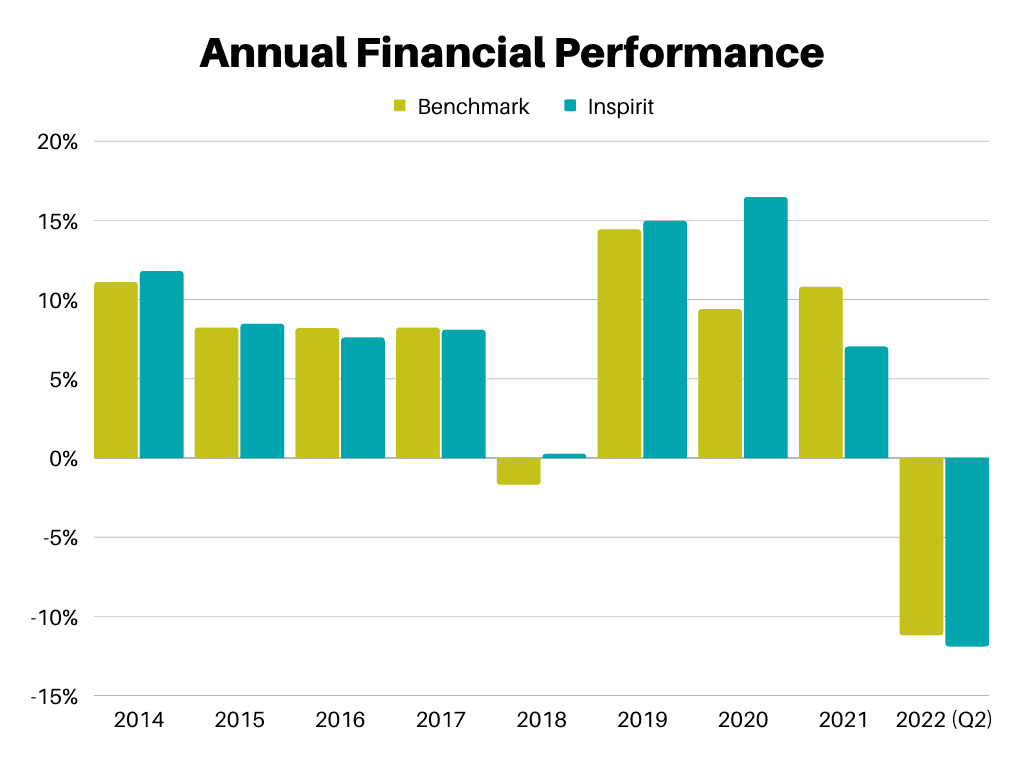

It’s true our portfolio has been hit hard from an absolute perspective – down 11.9% year to date – yet we have managed to land within a close distance of our benchmark, trailing it by only 0.7%. Given the outsized performance of oil and gas in Canada, we were very comfortable with our results to date, especially since Inspirit continues to overperform our benchmark since inception by a cumulative 2.6%. The graph below compares Inspirit’s annual performance relative to an industry-standard benchmark.

Our benchmark is a combination of industry-standard indexes, like FTSE TMX Universe Bond for the fixed income allocation of our portfolio, S&P/TSX Composite for Canadian equities, and MSCI ACWI (CAD) for global equities. The overall benchmark is a composite of the above, weighted by investment policy target weight.

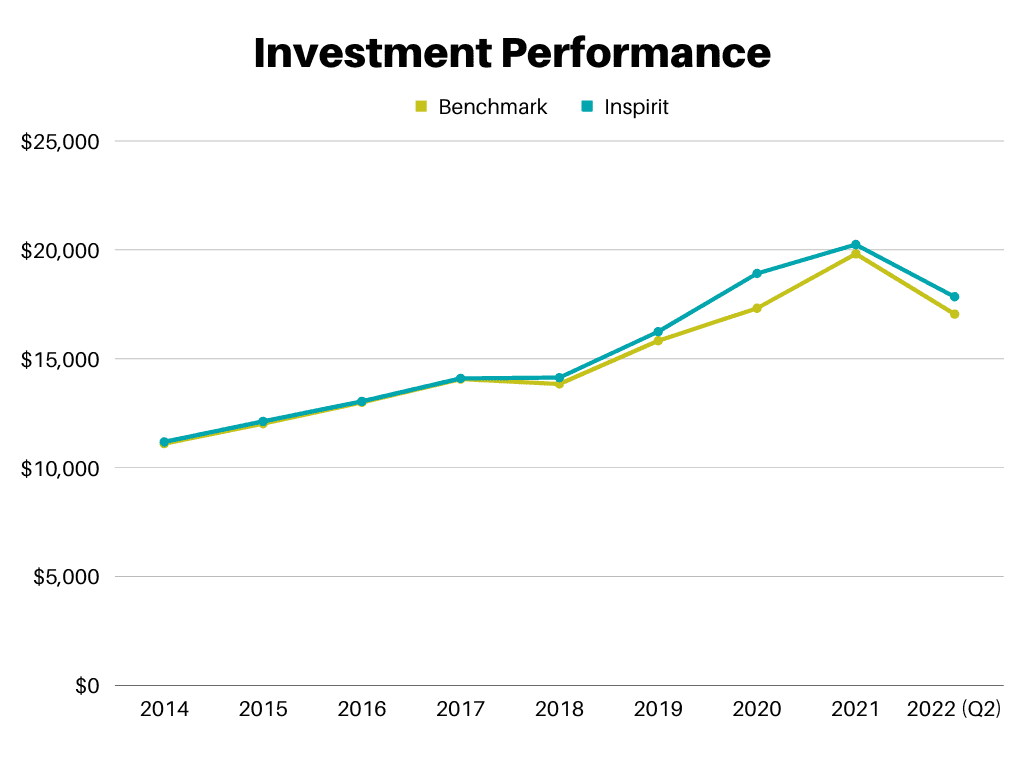

To visualize performance another way, below is a hypothetical $10,000 investment in our portfolio versus the benchmark since inception. Even after a relatively rough 2021 and first half of 2022, our portfolio’s performance still outpaces the benchmark.

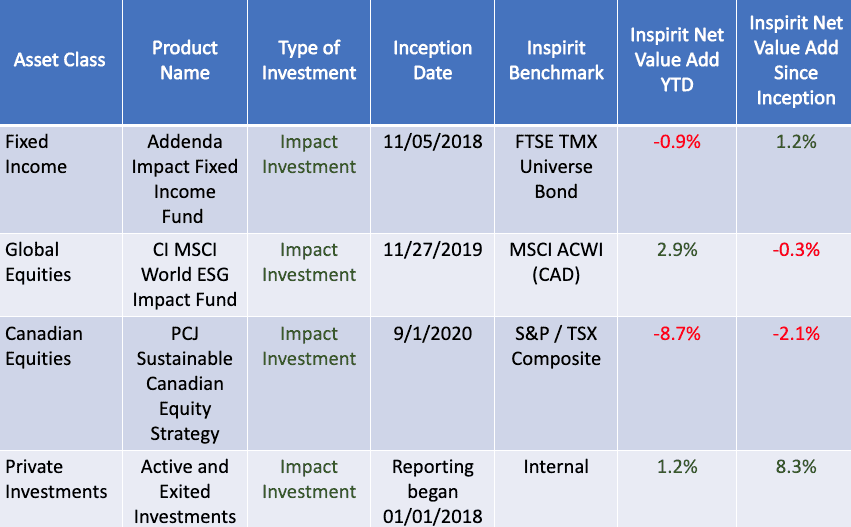

Evaluating performance from an asset class perspective yields interesting results. Overall, our private investments are generating positive gains, carrying some of the load for our public market investments. Our fixed income portion continues to add value relative to benchmark since inception, while our global equities allocation is inching closer to positive value add too.

Evaluating performance from an asset class perspective yields interesting results. Overall, our private investments are generating positive gains, carrying some of the load for our public market investments. Our fixed income portion continues to add value relative to benchmark since inception, while our global equities allocation is inching closer to positive value add too.

It’s been a tough time for our Canadian equities mandate. Our lack of exposure to carbon-intensive sectors like energy (oil and gas) and materials (mining, etc.) as well as sectors that fund high-emitting projects (banks and insurance companies) – has negatively impacted performance relative to benchmark over the past couple of years. However, our commitment to driving positive social and environmental impact through our portfolio is long-term. We won’t shift our strategy based on market cycles, and we’re hopeful our Canadian equities mandate will recover in the near future. We already have reason to believe relative performance is improving, mainly due to decreasing oil prices.

Despite this market downturn and relative underperformance of our portfolio in 2022, we’re not panicking. We’re riding this wave, and we’ll stay the course even if the ebb is steeper and longer than anticipated. Such is life during a pandemic.