Part Two of Jory and Jill’s Personal Impact Investing Journey

by Jory Cohen, Director of Social Finance and Investment

In my previous post I outlined how my wife Jill and I committed to a personal 100% impact investing portfolio. Using the United Nations Sustainable Development Goals as a framework, we committed to align all our investable assets with our vision of how we want the world to be. This is the first update since that commitment, in which I outline our new investments in SolarShare’s Solar Bonds and CoPower’s Green Bonds.

A wonderful aspect of SolarShare’s Solar Bonds and CoPower’s Green Bonds is that these investments are accessible to all investors: both retail investors (everyday people) and accredited investors (people who earn or have lots of money). The norm for most private investing is that regulators like the Ontario Securities Commission only allow accredited investors to participate. These investors have income and asset levels over certain, very high, thresholds (we’re talking people with net assets north of $5,000,000 here). Only a very small percentage of the population meet those thresholds and qualify as accredited investors. Most people are classified as retail investors. Retail investors can invest in public investments but typically have restrictions around participating in private investments. Jill and I are retail investors, and we feel fortunate to contribute to the success of both SolarShare and CoPower.

Both SolarShare and CoPower are private fixed income impact investments that contribute to two of the United Nations Sustainable Developments Goals: providing access to clean energy and combating climate change.

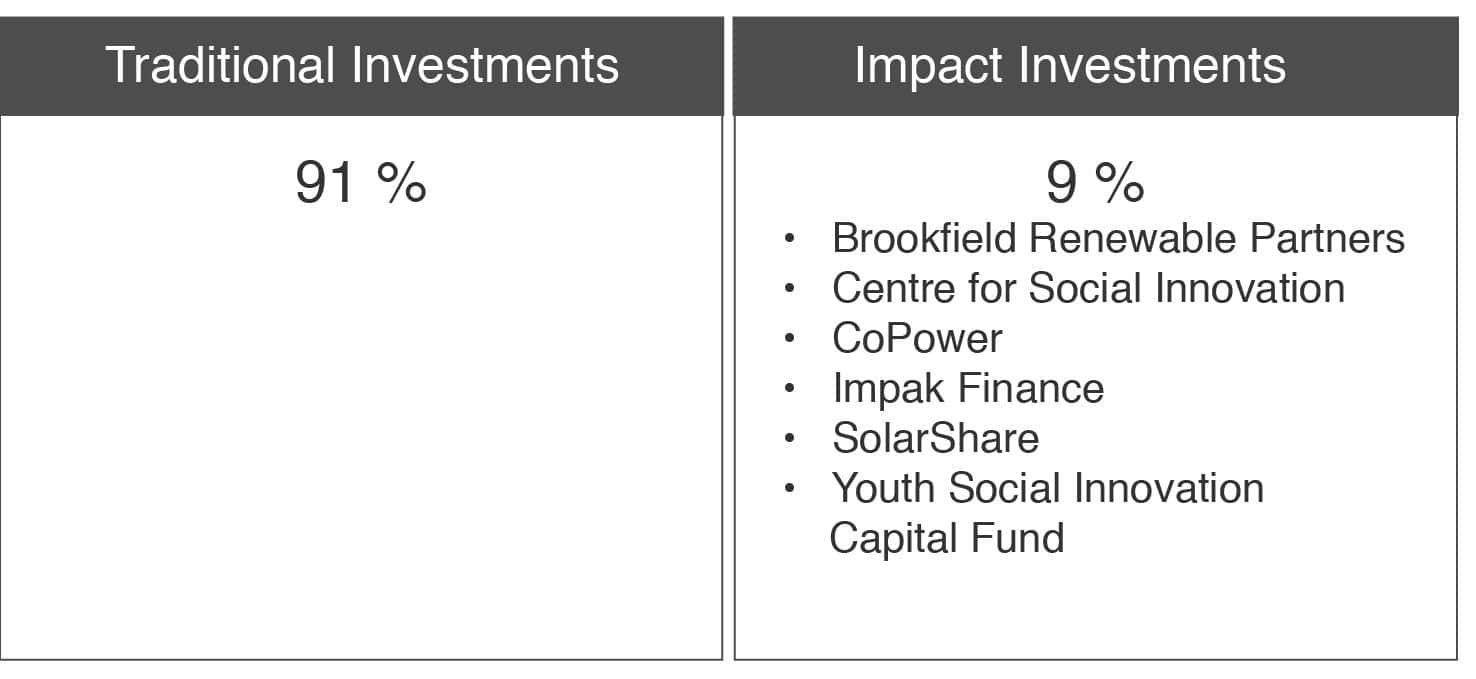

When we first shared our personal impact investment journey in May, 95% of our portfolio was allocated to traditional investments and only 5% to impact investments. Please see this previous post to see how we defined each investment category.

This current post is a snapshot of our portfolio, inclusive of our two new investments in SolarShare and CoPower. The two new investments increased our allocation to impact investments from 5% of our portfolio to 9%.

Our two new investments were made through private debt instruments. In order to finance their clean energy projects, SolarShare issues Solar Bonds and CoPower issues Green Bonds – both are private fixed income products. Solar Bonds carry a 5% annualized interest rate and mature in five years. Green Bonds earn 5% compounding annualized interest and also mature in five years. Compound interest is a mechanism to boost overall returns since a bond’s earned interest is re-invested and then subsequently earns interest on that previously earned interest. In CoPower’s case, since their Green Bonds earn 5% compounding annualized interest, the overall returns of the Green Bonds will be higher than an annualized 5%.

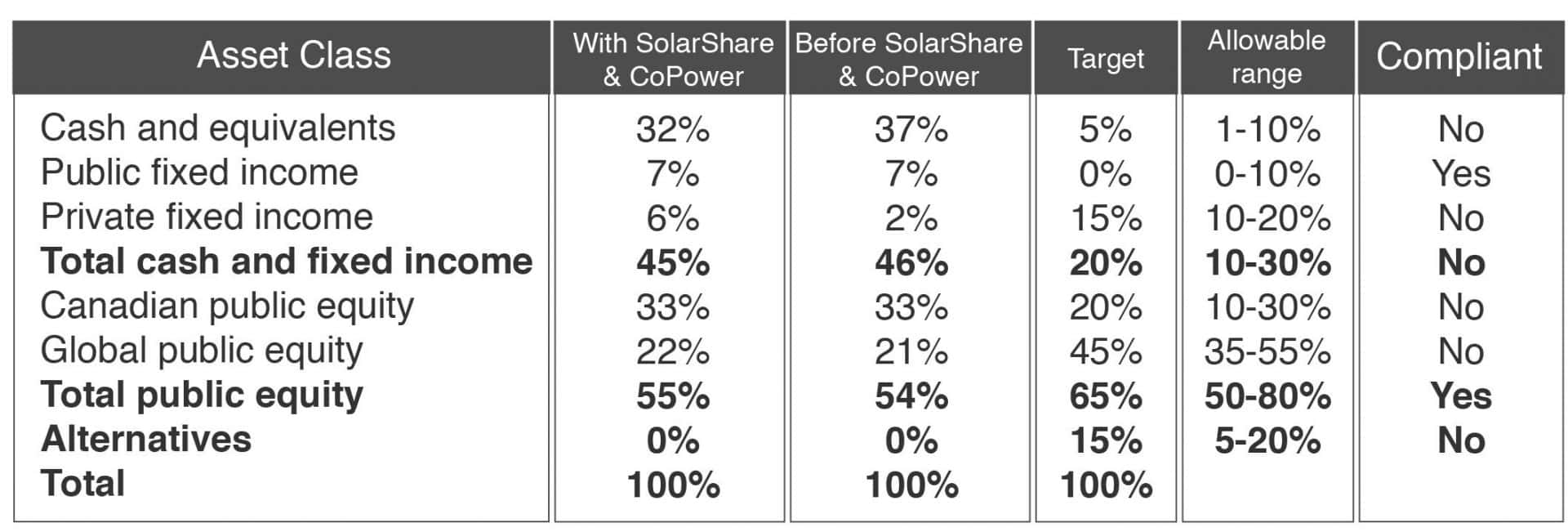

Below is a snapshot of our current portfolio from an asset allocation mix perspective (as of January 31, 2017) inclusive of our investments in SolarShare and CoPower.

In order to make these two investments, we transferred money out of a cash account to each respective investment. This allowed us to decrease our cash position and increase our private fixed income allocation, inching us closer to being compliant with our target asset mix allocation.

Here’s a little more about the mechanics and business model behind each investment:

SolarShare is an established leader in the clean energy sector in Ontario. With over $35 million in assets, SolarShare earns revenue by selling their outputted energy to the Independent Electricity System Operator for an agreed-upon price derived through the Feed-in Tariff program, which is a 20 year commitment from the Government of Ontario to purchase outputted clean energy at a set price. The annual interest payments associated with Solar Bonds are serviced through the revenue generated from these energy sales.

After five years, SolarShare is scheduled to return our principal investment. In the unlikely case of default, Solar Bonds are collateralized by the physical assets of their solar projects. When we assessed this investment opportunity, we found the likelihood of default to be very low, particularly because of SolarShare’s impressive track record and the Government of Ontario’s long-term commitment to purchase their outputted energy.

CoPower is headquartered in Montreal and has quickly become a leader in clean energy financing. It’s going to be really exciting to monitor their growth! CoPower services the interest payments from their Green Bonds through the revenue generated from solar projects and the cost savings produced by energy efficiency retrofit projects. After five years the Green Bonds are set to mature, and it’s at this time that we expect full principal repayment.

The solar projects financed by CoPower also have counter parties like the Independent Electricity System Operator that offer guaranteed energy purchase prices for an agreed-upon term, which tends to be 20 years. Their energy efficiency retrofit projects create savings by decreasing the usage of energy supplied from the grid. Whether in the form of LED lighting or geothermal heating and cooling, these retrofits decrease the reliance on grid electricity and result in monthly cost savings. Green Bonds are collateralized against the physical assets of the projects that CoPower finances, so there is physical security in the unlikely case of default.

Jill and I are proud to be invested with SolarShare and CoPower, two private fixed income impact investments. My next post will focus on why we invested in three public equity impact investment funds.

To learn more about impact investment opportunities in Canada, check out Open Impact, a user-friendly database created through a partnership between Purpose Capital and the Lee-Chin Institute at University of Toronto’s Rotman School of Management. Be sure to read Part 1, Part 3 and Part 4 of Jill and my personal impact investing journey.

DISCLAIMER: This blog post is not investment advice nor an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice.