Impact Investing and the Pandemic: Part 5

By Jory Cohen, Director of Finance and Impact Investment

Despite the pandemic, by the end of 2020, Inspirit had transitioned 98% of our portfolio to increase positive social and environmental impact. The lone asset class that had yet to be transitioned to increase impact? That is our cash, approximately 2% of Inspirit’s assets and the only portion of our portfolio that cannot be considered impact investing.

So we began 2021, determined to find a home for our cash, more specifically, a bank account solution that leverages ALL our deposits for positive impact.

After a thorough selection process, Inspirit is pleased to announce that we’ll be moving the cash allocation of our portfolio to Vancity Community Investment Bank (VCIB). VCIB has a mandate to leverage all their clients’ deposits as loans to affordable housing projects, clean energy initiatives, and social enterprises. We’re looking forward to partnering with VCIB on this portion of our portfolio.

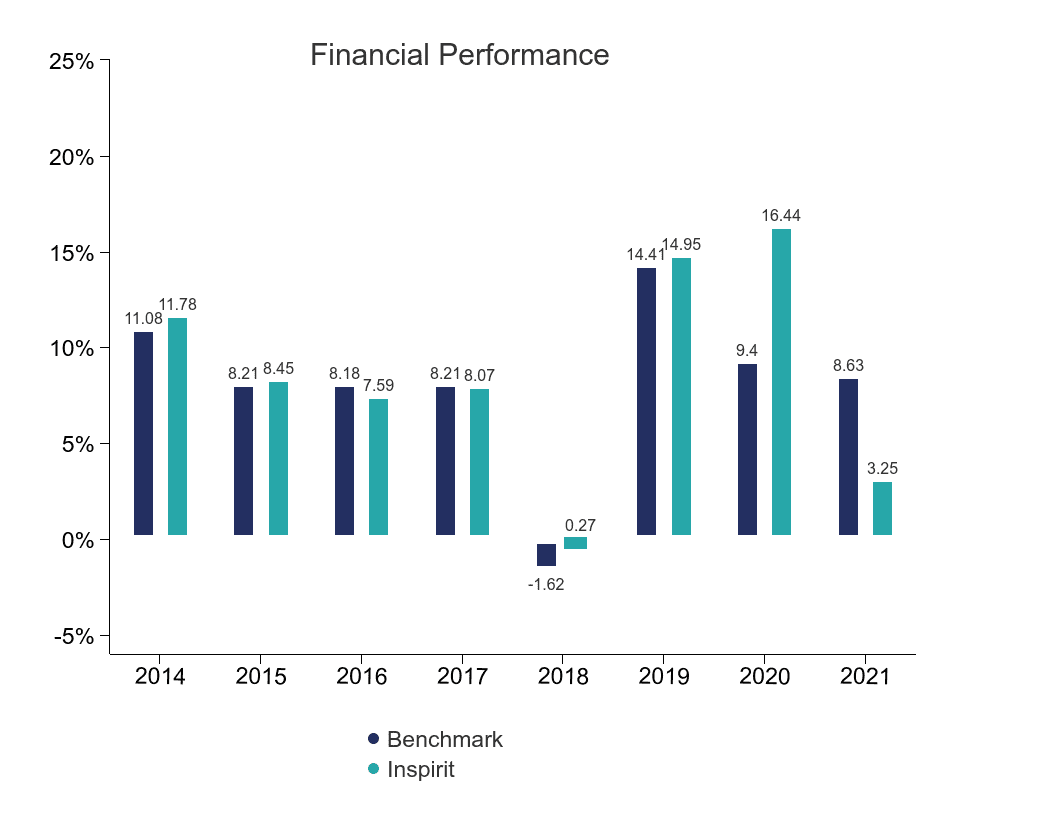

You may recall that 2020 was an incomparable year for Inspirit’s investment portfolio; our investments earned an annualized return of 16.44%, which is an impressive absolute yearly return, regardless of global context. What made 2020 even more significant was that Inspirit’s portfolio’s benchmark annualized return was 9.40%; meaning we outperformed benchmark by 7.04%. That’s a lot! Especially, considering that since inception, our portfolio’s performance has been within 1% of benchmark (with the exception of 2018 which had a value add of almost 2%). So…what happened?

In 2020, sectors that tend to generate positive impact like clean energy and healthcare — in which our portfolio is heavily weighted— performed exceptionally well. On the flip side, sectors like traditional energy and other carbon-intensive industries, like airlines, had poor financial results. Given Inspirit’s focus on creating positive impact, our exposure to those high-emission sectors and industries is virtually non-existent. That was a big factor in driving our high absolute and relative returns.

Fast forward to 2021, and our portfolio tells a different story. What happens when sectors like traditional energy rebound while clean energy dips? The result isn’t pretty for our portfolio, but it’s important to evaluate performance over a longer period of time than the first half of 2021—or any year for that matter.

At the end of the second quarter of 2021, our portfolio returned 3.25% year-to-date, relative to our benchmark’s return of 8.63% during that same time period. That’s an underperformance of -5.38% during the first half of the year. However, when we take a look at our portfolio’s performance since inception, we’ve still added 4.36% of value relative to our benchmark. That’s important to consider so we don’t evaluate performance based on a single period like 2020 or 2021. Below is a visual representation of our portfolio’s annual performance since inception.

For reference, Inspirit compares our portfolio’s performance relative to an industry-standard benchmark. Our benchmark is a combination of industry-standard indexes, like FTSE Canada Universe Bond for the fixed income allocation of our portfolio, S&P/TSX Composite for Canadian equities, and MSCI ACWI (CAD) for global equities. The overall benchmark is a composite of the above, weighted by investment policy target weight.

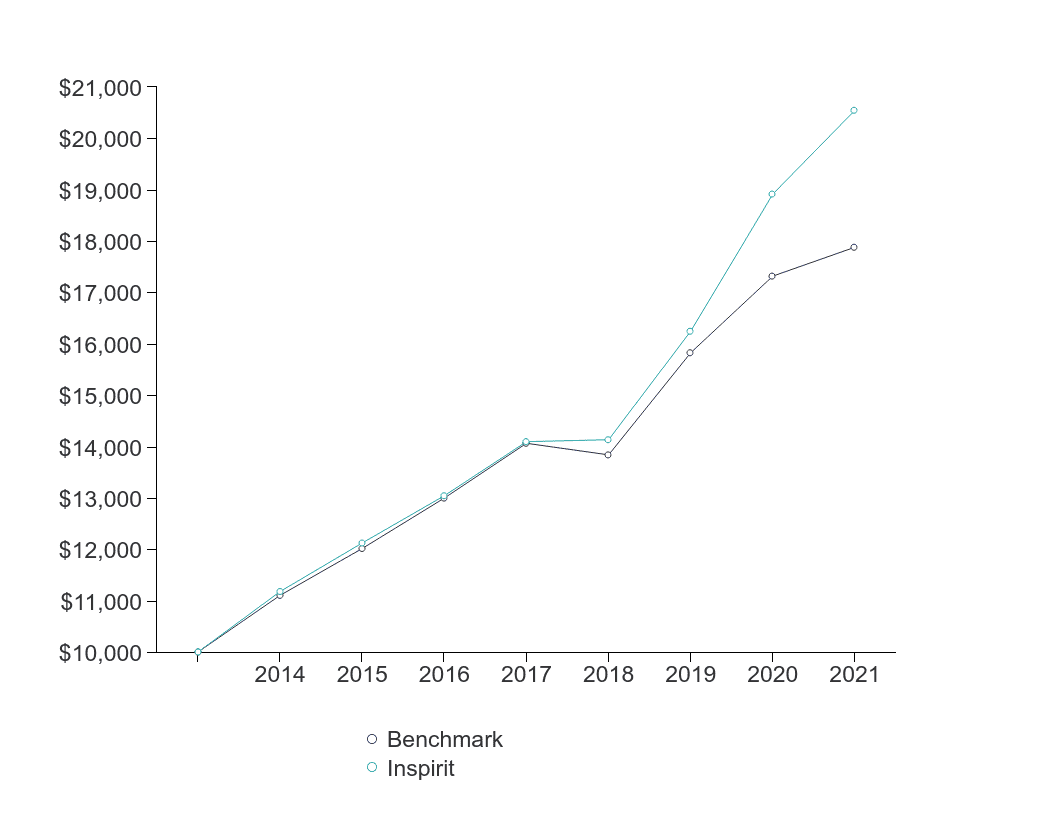

Here’s another way to visualize financial performance. In the charts below, look at how a hypothetical $10,000 investment in our portfolio performed relative to our benchmark since inception. It’s clear our portfolio continues to outperform, even when taking into account our performance in 2021. We’re counting on the outperformance cushion provided by 2020 to soften any relative loss to benchmark this year.

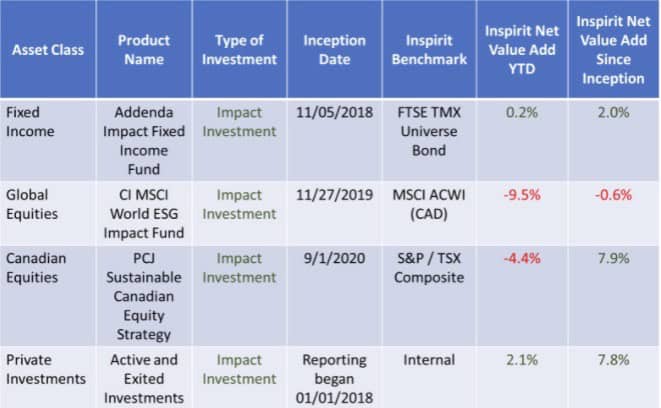

From an asset class perspective, take a look at our performance below since the inception of each impact mandate. A major takeaway is that, with the exception of our global equities which are hovering around benchmark, all asset classes transitioned to impact are still adding value relative to their benchmark, some in a very significant manner. We believe this is quite a feat.

As the calendar continues to flip, we’re keen to stay the course when it comes to our impact investing mandate. We believe this strategy will lead to higher probabilities of higher returns. We’ve been right so far, despite the first half of 2021.