Jory and Jill’s Impact Investing Journey: Part 14

By Jory Cohen, Director of Finance and Impact Investment

A lot has happened since my last post. As the pandemic’s fourth wave continues to persist, Jill and I welcomed our second (and almost certainly final!) baby into the world. Crosley was born in early September, and while we never really set out to do this, Jill and I found ourselves with two kids under two years old. Hayzen had his second birthday a month after his baby brother was born, so we definitely feel like we have our hands full at the moment.

Another piece of news is that we made our portfolio’s first private equity investment in Fresh City Farms. Based in Toronto, Fresh City delivers farm fresh, local, and organic produce–along with meal kits and hundreds of grocery items.

I learned about Fresh City back in 2013 when I was running the Youth Social Innovation Capital Fund (YSI), an impact investing fund that finances social enterprises led by young entrepreneurs. Founded a couple of years earlier, Fresh City started in 2010 as a company that grew local produce through sustainable practices at Downsview Park in Toronto, and delivered the fruits and veggies to homes around the GTA. By the time Fresh City applied to YSI for funding, they added local produce suppliers to their inventory. When Fresh City approached YSI for financing, their revenue levels were a couple hundred thousand dollars annually. Eight years later, that yearly figure is now in the tens of millions. YSI was Fresh City’s first provider of outside capital, a modest $10k loan.

A little while ago, I was catching up with Ran Goel, founder and CEO of Fresh City. It made me smile when we reminisced about how we first met back in 2013 and how far Fresh City has come since. Back then, Ran was a major reason why YSI supported Fresh City. I remember the YSI team was really impressed with Ran and his vision for the company and dedication to sustainable food practices— not to mention his background as a corporate lawyer in New York City. My admiration for Ran has only grown since then, especially because I know how committed he is to his three young kids.

Check out Inspirit’s Q&A with Ran:

There’s been a lot of growth for Fresh City since its inception. From offering a subscription to sustainably sourced groceries, meal kits, and on-demand prepared meals, multiple brick and mortar stores in the city, along with the acquisition of Mabel’s Bakery and the Healthy Butcher, Fresh City is quickly becoming the go-to for sustainable food in Toronto. I’m excited to have a front row seat for Fresh City’s future growth. Ran has big plans for the company, and I feel very fortunate to get such a close view of Fresh City’s development.

One of the privileges of being an investor in Fresh City is the ability to vote on new members for the company’s board of directors. I know Ran well and certainly don’t doubt his desire and ability to build an inclusive and equitable board—he’s deeply committed to social justice. Despite being Fresh City’s smallest shareholder, I have the opportunity as an investor to vote on board elections. I’ll be making my voice heard around board composition whenever I can, and I expect that Fresh City’s investors and board members will be united on this front.

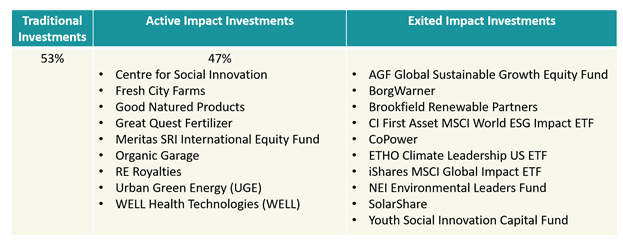

This is a large investment for our portfolio. Before investing in Fresh City, 30% of our portfolio could be classified as impact investments. With Fresh City in the mix, almost half of our portfolio has transitioned to impact. [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

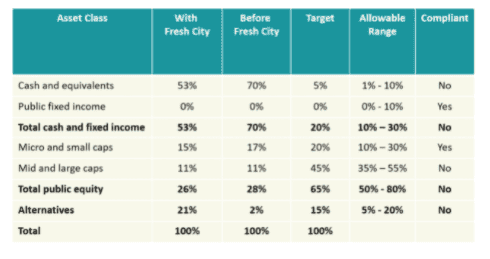

It’s probably worth mentioning how the investment in Fresh City was structured because it has a significant effect on the composition of our portfolio. We committed a large chunk of our portfolio to this investment, and roughly half of our commitment has already been allocated to the company. The remaining portion will be invested in Fresh City at a later date. Even with only half of the investment actually held by the company, it still accounts for approximately a fifth of our portfolio. Once the full commitment has been invested, it’s possible around 40% of our portfolio will be represented by the Fresh City investment. That’s a lot!

Remember the very basic investing principle of diversification? I threw it out the window! I decided to ignore the idiom of not putting all my eggs in one basket and instead am heeding the advice of Andrew Carnegie who said, “Put all your eggs in one basket, and then watch that basket.” (By the way, the source of that quote is contested, but that’s beside the point). Please remember, this is not investment advice. This is a highly unusual investing strategy. Be warned, don’t try this at home!

There’s one other change to our portfolio. Our investment in CoPower has been repaid in full, even before the expected maturity. CoPower was acquired by Vancity Community Investment Bank (VCIB), which allowed CoPower to access more affordable financing to fund their supported clean energy projects. That means that all the existing CoPower Green Bonds were replaced with less expensive financing provided by VCIB, resulting in full and early repayment to all Green Bondholders.

Taking into account the initial investment in Fresh City and the CoPower maturity, below is how our portfolio’s asset mix looks.

The big shift is the use of cash to fund the investment in Fresh City, which is classified in the alternatives section as a private equity investment. We will continue to use our cash to fulfill our commitment to Fresh City, which will lead to our portfolio being significantly overweight in the alternatives asset class. This is an intentional decision that will throw our portfolio out of whack when it comes to the target allocations, and I’ll go more in depth into this once that actually happens. We continue to be overweight in cash, but I’ll update through this blog when the cash continues to be put to use.

While the pandemic drags on, our kiddos are certainly keeping us distracted and busy. Wish us luck with potty training!

Disclaimer: This blog post is not investment advice nor is it an investment recommendation, so don’t take it as that and don’t rely on it! Seek independent professional investment advice.

[/vc_column_text][/vc_column][/vc_row]